Financial Advisors and Planners can demonstrate value and positively impact their clients’ lives in countless ways. Beyond merely providing financial advice, Advisors have the opportunity to build strong, trusted relationships with their clients and offer personalized, comprehensive services.

However, the reality is that demonstrating the value of financial planning can be really, really difficult.

Let’s start with looking at some of the different ways Advisors can have impact, and then we will dig deeper into some specific approaches to financial planning that have been proven to benefit both the client and the Advisory practice. If you’ve been struggling to show value, or unsure where to focus your efforts, this should help.

Financial Advisors & Planners can demonstrate value and positively impact their clients’ lives numerous ways.

Goal-Oriented Financial Planning: Work with clients to identify their short-term and long-term financial goals, whether it’s retirement planning, buying a home, funding education, or wealth preservation. Tailor a financial plan that aligns with their aspirations and provides a clear roadmap to achieve them.

Holistic Financial Assessment: Take a holistic approach to financial planning by considering all aspects of a client’s financial life, including investments, insurance, taxes, estate planning, and debt management. Addressing the entirety of their financial situation will lead to more comprehensive and effective advice.

Education and Empowerment: Educate clients about financial concepts, investment strategies, and potential risks. Empower them to make informed decisions and develop a deeper understanding of their finances. This approach builds confidence and trust in the Advisor-client relationship.

Regular Reviews and Updates: Schedule regular meetings with clients to review their financial plans, reassess goals, and adjust strategies as needed. Life circumstances change, and financial plans should adapt accordingly.

Behavioural Coaching: Help clients navigate emotional biases and make rational financial decisions. Behavioural coaching can prevent impulsive actions during market volatility and keep clients focused on their long-term objectives.

Download your free digital marketing guide for Canadian Financial Advisors, Planners, and Investment Managers here.

Risk Management: Analyze a client’s risk tolerance and design an appropriate investment portfolio. Implement diversification strategies to manage risk effectively.

Tax Efficiency: Minimize the tax burden on clients’ investments and overall financial plan. Tax-efficient investing can significantly enhance long-term wealth accumulation.

Estate Planning: Assist clients in creating or updating their estate plans, including wills, trusts, and beneficiary designations. Ensuring their assets are distributed according to their wishes and with minimized tax implications is crucial.

Transparency and Ethical Practices: Be transparent about fees, conflicts of interest, and any potential limitations in the services provided. Operating with the highest ethical standards helps foster trust and long-term client relationships.

Technology Integration: Leverage technology to provide clients with real-time answers and recommendations. Automated tools can streamline processes, enhance communication, and improve overall client experience.

Lifelong Learning: Stay updated with industry trends, financial regulations, and best practices. Continued education allows Advisors to provide the most relevant and up-to-date advice to their clients.

Proactive Communication: Be responsive and proactive in communicating with clients. Address their concerns promptly and keep them informed about changes in their financial plans or market conditions.

Download the ultimate 👨👩👧👦 Financial Planner Toolkit 📊 for helpful planning resources, such as a client-facing Financial Planning Questionnaire, a New Financial Plan Checklist, and more.

Client-Centric Approach: Tailor financial advice to each client’s unique circumstances, needs, and preferences. Recognize that every individual or family has different goals and aspirations.

By adopting these practices and focusing on the well-being and success of their clients, Financial Advisors and Planners can demonstrate value and have a positive impact on their clients’ lives. Remember, it’s not just about managing money; it’s about helping clients achieve financial security, peace of mind, and the ability to pursue their dreams.

Specific approaches to financial planning that can be used to achieve these benefits for clients.

So how can you, the Financial Advisor, help your clients? What specific approaches to financial planning are going to have the greatest impact? Here are some top, proven approaches to consider.

Budgeting: Budgeting involves creating a plan for income and expenses over a specific period. It helps individuals and businesses allocate their resources wisely, track spending, and identify areas where adjustments can be made.

Goal-Based Planning: This approach focuses on setting specific financial goals and designing a plan to achieve them. It involves determining objectives like saving for retirement, buying a home, paying off debt, or funding education, and then creating a roadmap to reach those targets.

Below, you can see goals-based planning in action. In Snap, we call these goals “Additional Expenses”.

Cash-Flow Management: Cash-flow management involves monitoring and controlling the flow of money into and out of an individual’s or organization’s accounts. It helps ensure that income is sufficient to cover expenses, allows for savings, and identifies potential cash-flow issues.

Below is an example of cash-flow management happening in real-time using Snap Projections.

Investment Planning: Investment planning entails creating a strategy to grow wealth by making informed investment decisions. It involves assessing risk tolerance, setting investment goals, diversifying portfolios, and regularly reviewing and adjusting investments.

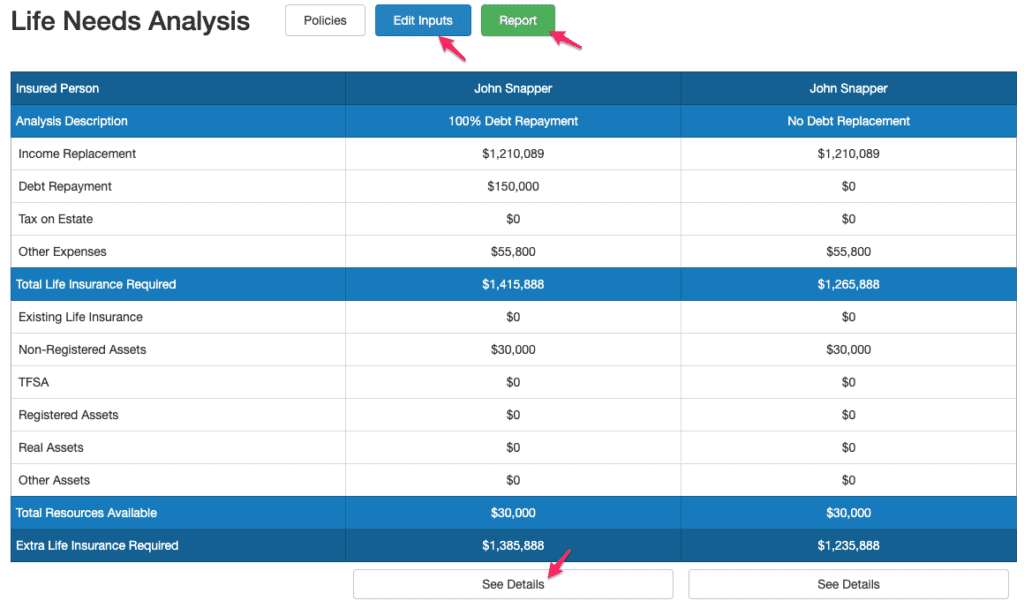

Risk Management and Insurance Planning: This approach involves identifying potential risks and developing strategies to mitigate them. It includes assessing insurance needs (e.g., life, health, property, liability), ensuring adequate coverage, and understanding risk tolerance.

Use the Life Needs Analysis Module in Snap Projections financial planning software to provide your clients with customized recommendations to help them protect what’s most important.

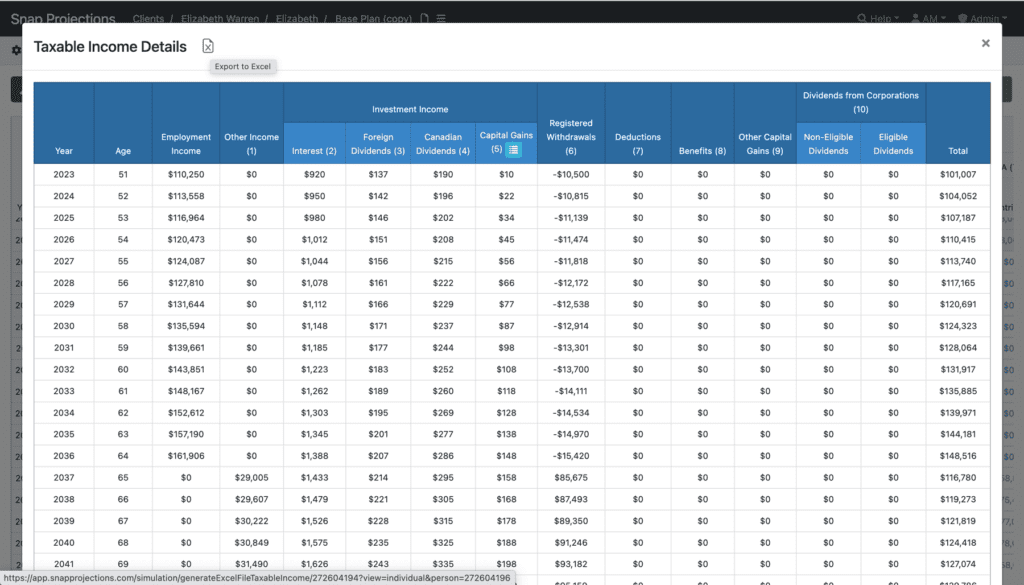

Tax Planning: Tax planning aims to optimize tax efficiency by utilizing available tax deductions, exemptions, credits, and strategies. It involves understanding tax laws, organizing finances to minimize tax liability, and considering long-term tax implications.

In Snap Projections, you can access the Taxable Income Details chart right from the main planning page. This provides complete transparency for the Advisor and sets the foundation for tax planning conversations with clients. You can even export the data to Excel.

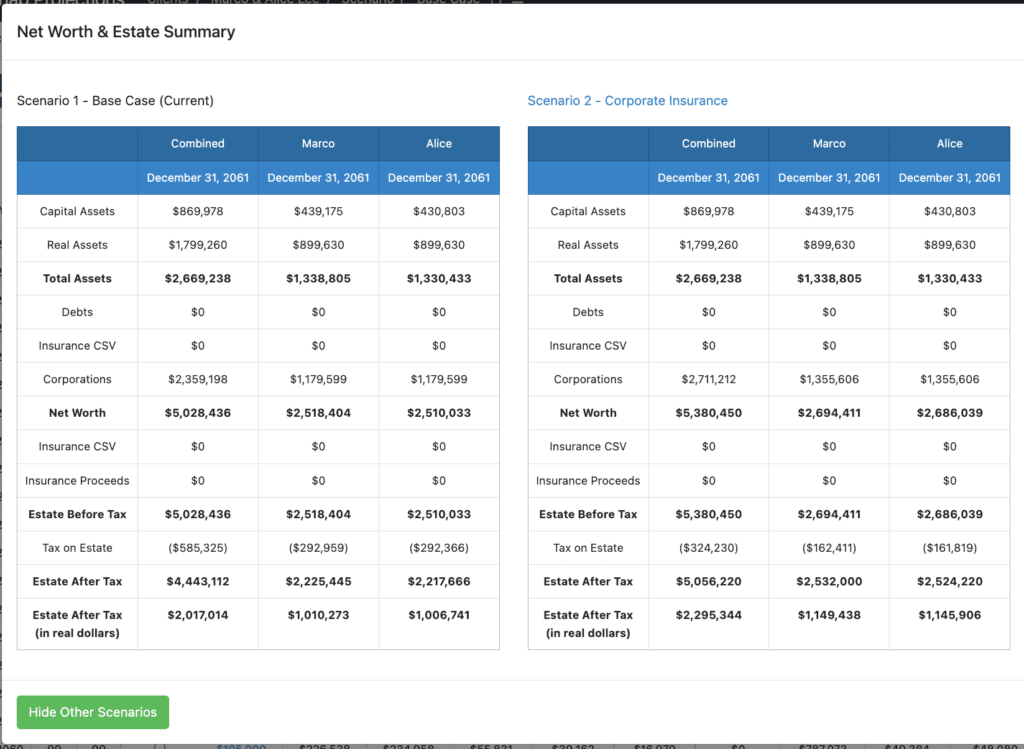

Estate Planning: Estate planning involves creating a plan for the management and distribution of assets after an individual’s death. It includes preparing wills, establishing trusts, designating beneficiaries, and minimizing estate taxes.

Net Worth and Estate Summary Charts (comparing 2 plans) in Snap Projections financial planning software.

Retirement Planning: Retirement planning focuses on accumulating savings and investments to support a comfortable retirement. It includes estimating retirement needs, choosing appropriate retirement accounts, and implementing decumulation strategies to reach retirement goals.

Here is how you can provide real-time retirement planning Recommendations in Snap.

Debt Management: Debt management involves developing a plan to effectively manage and reduce debt. It includes analyzing debts, prioritizing payments, exploring debt consolidation or refinancing options, and creating strategies to become debt-free.

These approaches may overlap, and the specific emphasis placed on each can vary depending on individual circumstances, goals, and preferences. Focusing on just one area can be a great place to start.