As Canadian retirees approach age 72 and have investments in a Registered Retirement Income Fund (RRIF), they are required to withdraw a minimum amount each year. However, some retirees may consider withdrawing more than the minimum and starting earlier in order to maximize their future funds for routine living expenses or their estates.

While this approach may seem advantageous, the reality is that it’s more complicated than it appears. Financial planners need to assess each retiree’s unique circumstances and consider the full complexity of their situation when recommending the most suitable withdrawal strategy.

The value of withdrawing more from RRIFs than necessary at an earlier stage has been examined by the FP Canada Research Foundation, which funded research conducted by Doug Chandler, an Actuary with a focus on retirement research and an Associate Fellow of the National Institute on Ageing.

In the video, Doug says that he approached this research with two primary planning objectives:

👨👩👧👦 how to maximize the value of the estate for beneficiaries, and

📊 how to minimize the risk of financial distress during the individual’s lifetime

The comprehensive research paper can be accessed here: Retirement Drawdown Choices – RRIF, TFSA, and Non-registered Accounts.

Download your free digital marketing guide for Canadian Financial Advisors, Planners, and Investment Managers here.

In the current climate of discussions surrounding RRIF withdrawal strategies, the research funded by the FP Canada Research Foundation is particularly significant. According to FP Canada, Financial Planners surveyed on the matter recently revealed that withdrawing a higher amount of RRIF assets, up to the client’s current tax bracket threshold, was their preferred option for boosting income in a tax-efficient manner. However, relying solely on rules of thumb may oversimplify a retiree’s complex circumstances. This could pose a problem for clients as projections based on a single hypothetical future scenario may be unreliable and misleading, as demonstrated by the research.

According to the research, accelerated RRIF withdrawal strategies may not always provide the expected benefits. Although withdrawing more than required from a RRIF and doing so before age 72 may be advantageous for some, the research suggests that the perceived advantages may be overestimated. This is especially true for retirees whose investment returns vary from the average expected return.

When evaluating RRIF strategies for a client, financial planners must take into account various factors, such as the client’s potential lifespan and future investment returns.

It’s important to note that relying on projections based on a single age and set of returns can create undue risk. Therefore, financial planners must consider a retiree’s unique circumstances and create a personalized strategy accordingly.

In FP Canada’s press release, Doug Chandler is quoted commenting, “When helping a client determine when and how to withdraw from a RRIF, there are complexities involved, and many unknowns. This research demonstrates the importance of seeing the bigger picture. That means accounting for things like current and future tax rates, income-splitting opportunities, investment risks and returns, and more.”

In the video above, the results of this research paper are discussed alongside Doug Chandler and two Canadian financial planning software providers who specialize in supporting Financial Advisors who require tools to model asset decumulation for Canadian retirees. Spoiler alert — one of the providers is yours truly, Snap Projections.

Snap Projections entered the financial planning software space nearly 8 years ago for this very reason. It was evident there was a gap in the marketplace and that independent Canadian Financial Advisors did not have access to easy-to-use, transparent, and flexible software to model personalized asset drawdown strategies for their clients. Snap was happy to contribute to this important project that ultimately validated what they believed all along — there is no “one size fits all” solution when it comes to drawdown choices. Client goals and individual circumstances will change the outcome for every scenario, so it’s crucial for Advisors to have the right information and resources to be able to determine the optimal potential outcomes.

The research was able to confirm and clarify a list of best practices for Financial Planners that are specific to the decumulation stages of financial planning. Within these notes is a reminder from FP Canada about the rules governing that CFPs and QAFPs can both understand and validate what’s under the hood of the technology they use to create financial plans.

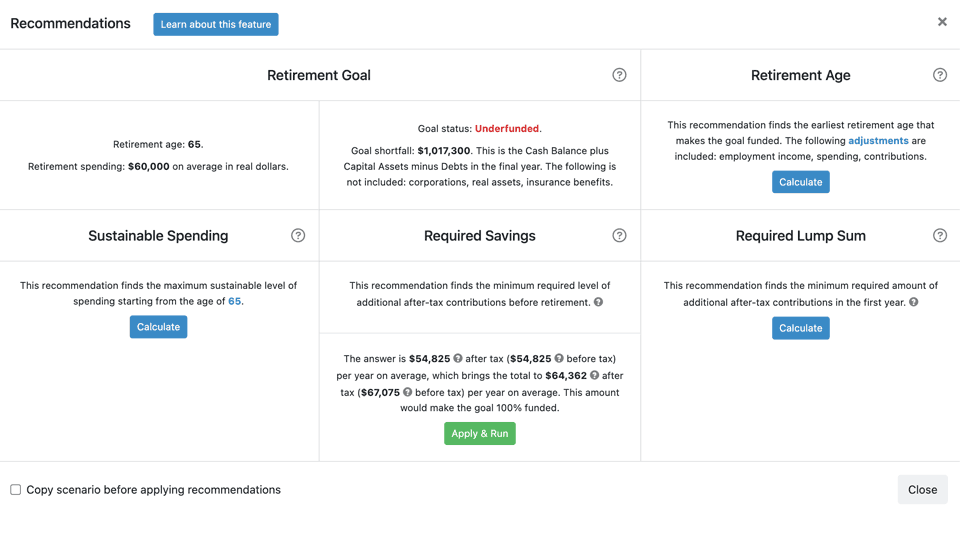

Within Snap Projections, it’s simple to create an individualized drawdown plan that accounts for crucial elements such as longevity, varying rates of return, client goals, what-ifs, and more.

You can also build out multiple scenarios in real time to compare multiple sets of variables. You can see this in action by watching the video above.

Want to try it for yourself? You can start a 14-day Free Trial of Snap Projections here.

Upon creating your account, you’ll receive a Welcome Package with everything you need to get started, including a link to book your individual Onboarding & Training session with an experienced Snap team member.