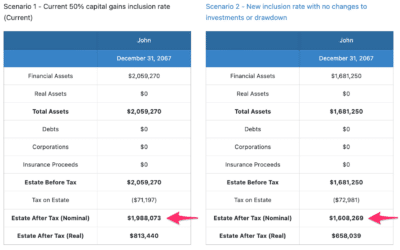

As everyone already knows, the new capital gain inclusion tax rules are planned to come into effect on June 25th of this year. Many of you, we have been told, are heading into the office this week not knowing what to show your clients. Here at Snap, we are being asked...

Financial Planning Blog

Get financial planning tips and CE-accredited webinar invites straight to your inbox.

Value only, never spam. You’re free to opt out anytime.

How Financial Advisors and Planners can start using social media to grow the Advisory practice

This article is for Canadian Financial Advisors, Planners, and Investment Managers who are not currently using social media in their practices and would like to start. We are going to cover the basics to get the ball rolling. We will take it one step at a time and...

Build the practice you want by defining your target clients (Marketing tips for Financial Advisors & Planners)

Building the practice you want takes time and concentrated effort. In the beginning, you may find it works to be more generalized with who you can help. But as your practice grows and evolves, at some point you will need to start making some decisions if you want to...

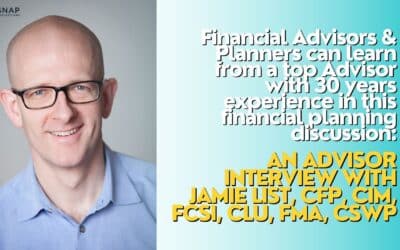

Advisor interview: learn from top Advisor Jamie List, CFP, CIM, FCSI, CLU, FMA, CSWP

On March 6, 2024, Snap user Jamie List sat down with Snap Projections for an interview to share his background and depth of knowledge after working in the Canadian financial services industry for the last 30 years. Jamie is the co-founder of Bearing Capital Partners,...

Financial Planning for Advisors: How to provide personalized planning for multiple clients efficiently

This tutorial tackled a challenge many Advisors are dealing with — and that’s how to remain efficient when clients have drastically different planning goals and concerns. How can you provide highly personalized advice, addressing multiple concerns and clients, and...

How to create your unique value proposition as a Financial Advisor, Planner, or Wealth Manager

As a Financial Advisor, Planner, or Investment Manager who wants to differentiate themselves and stand out from the pack, it’s important to develop a compelling value proposition. This statement is how you will attract your ideal clients and build the type of practice...

How to Define your Target Audience & Set Actionable Goals [Marketing tips for Financial Advisors]

When it comes to marketing your Advisory practice, one of the first stages is getting clear on who you want to serve and why, and determining a process to set clear and actionable goals. In this article, we are going to cover these two fundamental stages of...

Financial Advisors & Planners can create financial plans in 5 minutes with this financial planning software

In this video, you are going to witness how a basic financial plan can be built from end to end, in just 5 minutes using Snap Projections financial planning software. https://youtu.be/JTqPLnQSsMw Canadian Financial Advisors, Planners, and Investment Managers are...

How Advisors Can Do More Planning with Less Data Entry & Help Their Clients to Maximize TFSA & RRSP Contributions

In this previously recorded session, the Snap Customer Support team is addressing commonly asked financial planning questions that come from Snap users. Snap users are Canadian Financial Advisors, Planners, and Investment Managers. This was filmed on January 10, 2024....

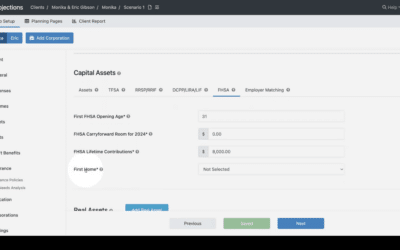

Financial Planning Tutorial: How to Model the new FHSA with Cash-Flow & Goals-Based Projections

As a Financial Advisor, Planner, or Investment Manager, how can you best help and prepare your clients for their futures? Every client, every case, is going to be completely unique. While yes, there will be commonalities and themes, what truly matters to each...

Advice Expected But Not Delivered is How Financial Advisors Lose Clients (video tutorial)

If a client asks, how much more do I need to start saving in order to meet my retirement goals? and their Advisor can't tell them, it's a problem. If it takes them a long time to determine the answer, that's a problem, too. Advice expected but not delivered is how...

Financial Planning Software Tutorial: Simple Does Not Mean Easy

Here at Snap, we've always tried to keep things simple — especially when it comes to the use of our financial planning software. We've always pushed to ensure we keep it simple to use, but that does not mean sacrificing features and flexibility. Because simple does...

![How to Define your Target Audience & Set Actionable Goals [Marketing tips for Financial Advisors]](https://snapprojections.com/wp-content/uploads/2024/03/pexels-engin-akyurt-1552617-400x250.jpg)