As a Financial Advisor, Planner, or Investment Manager, how can you best help and prepare your clients for their futures? Every client, every case, is going to be completely unique. While yes, there will be commonalities and themes, what truly matters to each individual is highly personal. Each person has their own goals, hopes, and unique retirement vision.

In this one-hour session, you will see how 3 highly individualized cases can be built and assessed. You will see how can we address cash-flow planning and goals-based planning questions, while additionally modelling the new First Home Savings Account (FHSA) in the third scenario. The video will focus on 3 simple plans and you will witness each built from end to end, providing you with actionable insight into how you can be addressing these questions for your own clients.

This CE-accredited financial planning session was filmed on December 13, 2023. Live attendance was required to be eligible for applicable Credit. During the video, you’ll also get a sneak-peak of Snap’s upcoming new release, a one-page summary report. This will be a complete game-changer in the way you can present the plan to your clients. You can review the video from Snap’s Product Manager if you’d like to know more about this upcoming release.

The 3 cases that will be built and modelled in this financial planning tutorial are:

1. A plan showing how we can illustrate savings and withdrawals to achieve a consistent and sustainable lifetime spending level.

In this case, the clients don’t necessarily have a goal but they are concerned about cash-flow and are looking for guidance on what they’re doing, so they’re not caught off guard by something in the future. The general client profile here is someone who doesn’t really have a plan or goal in mind. They just want to ensure they’re consistent and have a sustainable lifetime spending plan in place.

Download your free digital marketing guide for Canadian Financial Advisors, Planners, and Investment Managers here.

This is one of those cases where you can leverage the cash-flow management feature to start earlier, rather than delaying that until retirement. Additionally, this case will dig into the decumulation process. The plan will start with the software’s default, which is the withdrawal from the non-registered first, followed by the TFSA, and then the Registered accounts, blending in any tax-free withdrawals that can be happening simultaneously. You will be shown how you can control and modify the system defaults to create your own customized withdrawal order, to ensure you can optimize the drawdown for each client.

2. Determine the required savings to achieve a target retirement spending goal.

In this case, the client is about ten years away from retirement with a very specific spending goal in mind. They want to know if they are on track to meet this spending goal and determine if any changes or additional savings will be required to achieve their specific spending goal. If they are not on track, what do they need to do to get themselves there?

We can provide personalized recommendations to ensure the client will be able to meet her retirement spending goals. We can explore potential strategies such as adjusting the retirement age, or determine what additional annual savings would be required to meet that goal, if we determine she is not on track to meet her target spending. The general client profile here is someone who has a very specific goal, and we can use the recommendations module to help get them where they want to be.

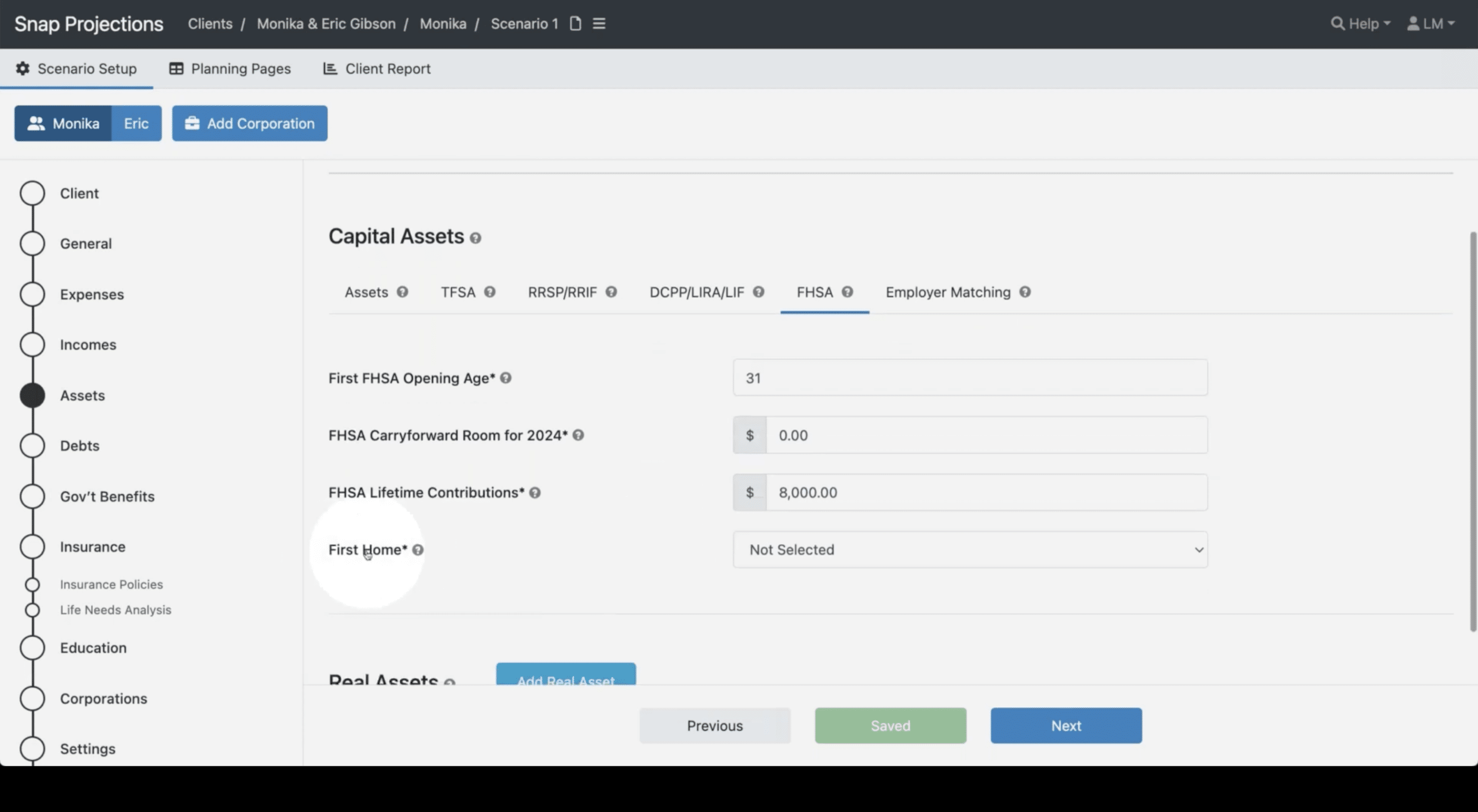

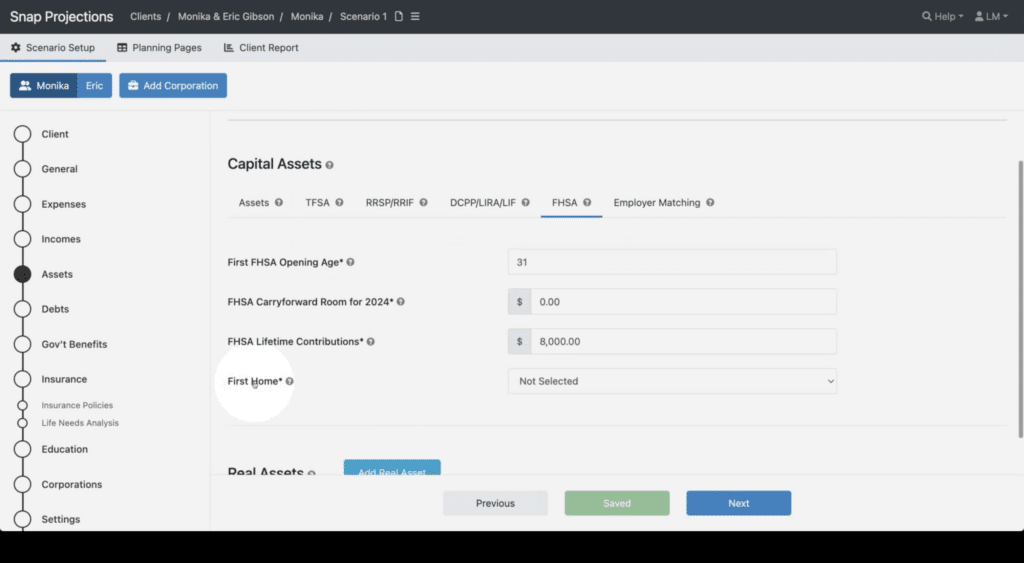

3. Model a younger couple scenario leveraging the First Home Savings Account (FHSA).

In this case, the clients aren’t concerned about what may happen thirty years from now. They are focused on a major life event, purchasing their first home. We can use the new functionality in Snap to model the use of the FHSA, and help the clients to model what the upcoming financial impacts will be of making this purchase and even model taking on a future mortgage.

In December 2023, Snap announced the release of the new First Home Savings Account (FHSA) in the software. You can view that announcement and learn more about the module, and you can see a detailed video from Snap’s Product Manager on this new feature release for the FHSA here.

This financial planning tutorial will provide you with actionable tips and strategies to help your clients. You will see how transparent, easy-to-use, and highly flexible Snap is, as you can quickly and efficiently address 3 very different types of client profiles. In this video, you are seeing how to help a client who has no specific goal, how to ensure a client with a specific goal can be sure to meet it, and how to help a younger couple plan for the first home purchase using the new First Home Savings Account (FHSA).

If you’d like to follow along during the tutorial, Canadian Financial Advisors, Planners, and Investment Managers are eligible to start a 14-day Free Trial of Snap Projections financial planning software.