As a Financial Advisor, you already know that your clients continue to demand more value in each and every client meeting. To facilitate this, Advisors rely on information, speed, and simplicity from their financial planning software during retirement planning discussions. Most likely, your clients are not coming to you, asking for a financial plan. They are, instead, coming to you with financial questions. As the expert, you know that these questions can be addressed through the financial planning process.

As you work through the financial planning process, what happens if you determine that retirement goals are either over or underfunded? What can you do to help, and how can you provide transparent recommendations to your clients?

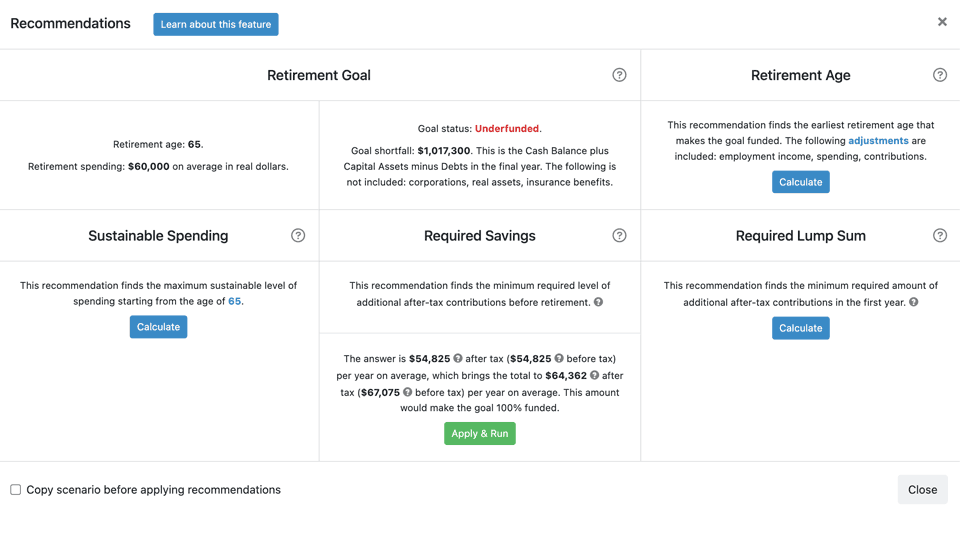

This is why we created Recommendations. This new feature will empower Advisors to quickly illustrate to their clients their retirement spending goal, what they are on track for already, and what options they have to close any gaps. This means that now, Advisors can run more “what-if” scenarios in less time and with less effort. As a result, they can spend more time creating value for their clients through meaningful discussion and less time is spent on manual (trial and error) software operations.

Download your free digital marketing guide for Canadian Financial Advisors, Planners, and Investment Managers here.

The Recommendations feature is ideal for clients who are either pre-retirees or younger clients who are starting to plan for their futures. With Snap’s new recommendations feature, you can now instantly help your clients explore what actions they can take TODAY to ensure their future retirement goals are met.

We know that one of your clients’ most important questions is: how much can I afford to spend during retirement?

But what happens when that number isn’t enough? What happens next if you determine that your client can’t afford to spend what they need or want once they retire? That’s when the next round of questions start.

- How much MORE do I need to be saving each year in order to reach my goals?

- What age can I afford to retire at?

- How much do I need to reduce my annual spending by to ensure I don’t run out of money?

- Or, how much do I need to save from the sale of this business or property to ensure my retirement goals are fully funded?

Why we created Recommendations:

During the interview process, there was consensus among users that automating the recommendations process would be highly valuable, for several key reasons. Advisors tell us that their clients continue to demand more value and service from each and every meeting, and expect to receive answers quickly to their most important questions.

If the answer to “how much can I afford to spend” is not what the client was hoping for, the next line of questions will be around what can be done now to impact that number.

What our Advisors have told us they need:

After an Advisor meets with a client and inputs all required data to produce a base financial plan, Advisors say they then want the software to auto-calculate how much retirement spending their client is on track for and what options they have to close any existing gaps. Advisors tell us they also want the ability to make swift plan alterations and then have the software re-calculate these areas. Finally, they want the option to have the software implement the recommendations for them, creating transparency behind the recommendations and saving valuable time.

This is exactly why we built the new Recommendations feature.

How Advisors tell us they plan to use this new tool:

Here are the most common use cases for the Recommendations feature.

- Identify gaps/vulnerabilities between clients’ retirement goals and their current situation.

- Illustrate how the timing of retirement can affect the achievement of specific retirement goals.

- Illustrate how additional annual savings can help to achieve retirement goals.

- Establish whether some of the client’s capital assets can be repurposed toward goals other than retirement, such as purchasing a second property, supporting a loved one, or budgeting for an annual trip.

- Explore ways to increase estate value, such as funnelling a portion of capital assets into an insurance estate strategy or investing into a business.

- Illustrate how much money a client needs to put away today to achieve their retirement plan in the event of a windfall due to something like selling a business/land or receiving an inheritance.

- Present how unfavourable market conditions [by using the Stress-Testing module] can affect retirement funding strategies by combining stress testing with recommendations.

What current users of this new functionality are already saying:

…. “Recommendations will save me time on calculations and quickly allow me to generate client-facing what-if scenarios” …

… “This will save me time because it eliminates the need to produce multiple stand-alone what-if scenarios. I can now do it on one page” …

… “Recommendations will allow me to quickly produce high-level recommendations with little effort. It enhances the client-facing experience”…

… “It looks awesome! The automatic savings feature that optimizes where to save and is showing the before and after tax required savings is exactly what we need. Thank you.”

Want to try it for yourself?

Sign-up for your 14-day free trial and access the new Recommendations feature today.