As everyone already knows, the new capital gain inclusion tax rules are planned to come into effect on June 25th of this year.

Many of you, we have been told, are heading into the office this week not knowing what to show your clients.

Here at Snap, we are being asked questions such as …

“is the plan I created for an incorporated client 3 months ago still accurate?”

and

“should I hold off on planning for clients with capital gains until we know for sure?”

We want to ensure that as the Advisor, you are able to show your clients the impact of the proposed budget changes on their projections.

This is the only way to ensure they have the information they need to make informed decisions and have peace of mind knowing they will still reach their goals. The impact of these changes will be unique to each client situation and personalized recommendations will be required to determine the optimal outcome and path forward.

In many cases, it’s going to be a simple peace of mind exercise, but in others a change in strategy may be needed to deliver the optimal outcome. It’s all going to come down to what the client’s goals are.

You can now model the impact of the proposed changes to capital gains inclusion rates in Snap Projections.

If you fit into one of these categories, we have you covered:

- I want to begin advising my clients with the new rules now, to remain conservative.

- I want to see if I can make changes between now and June 25th that will optimize my clients’ outcome.

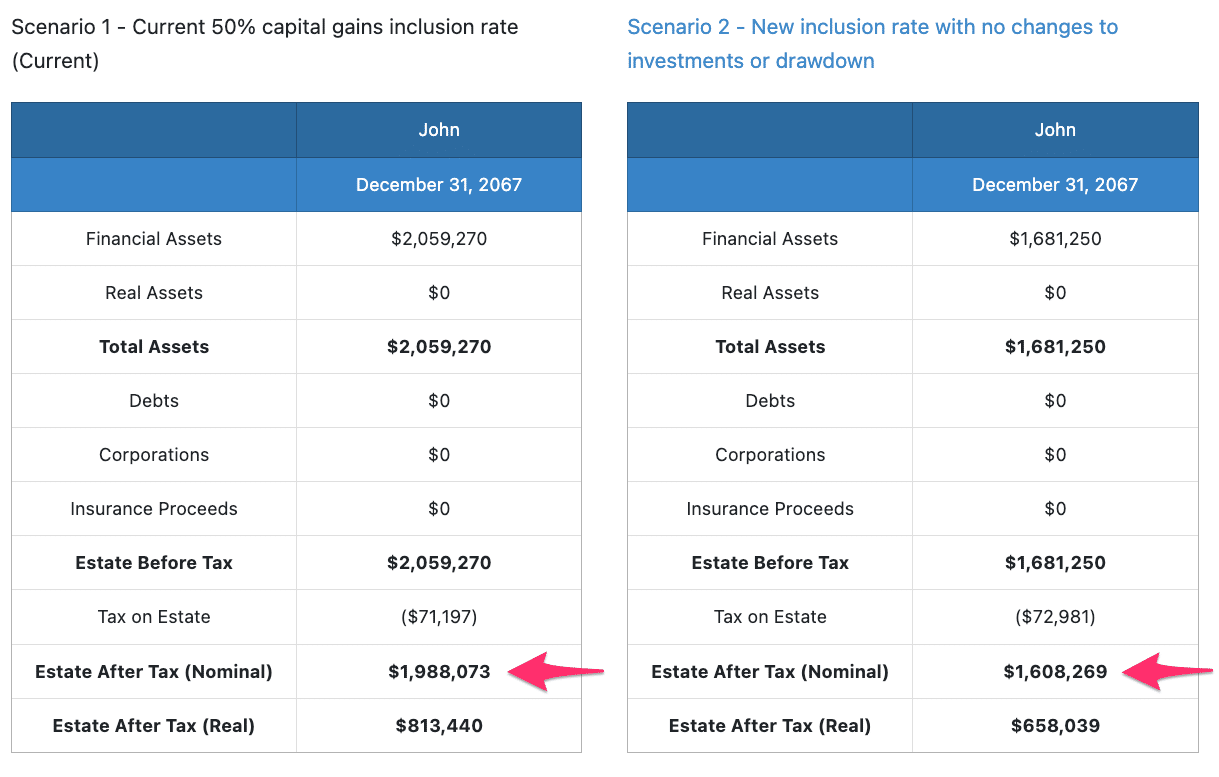

- I want to compare strategies and potential impacts of these changes by comparing current versus new rules.

- I do not wish to model these new changes as I do not think they will stand.

We have built a highly flexible solution that solves the following wants for our Advisors to address the planning impacts of the proposed changes to the capital gains tax thresholds.

Right now, new plans and current plans will default to the current rules. Once/if this passes, we will remove the Experimental feature and this would become the default in Snap. Until that time, we can still continue to plan with confidence amongst the uncertainty.

Advisors we have spoken to tell us their offices are divided on whether or not this will stand. Only time will tell, but the immediate need is the ability to continue to plan effectively during this time of uncertainty. This is what the new functionalities in Snap provide.

In this video, we’re covering option 3 above to show how we can use this new feature to quickly model potential impacts for a regular retired Canadian.

Betty is not a business owner, but she does own a cottage and has a large sum of equity in a non-registered account. Betty is worried she should be doing something right away to protect her financial future. She is retired and resides in Nova Scotia and hopes to keep the cottage in the family.

This means Advisors can now use Snap to:

- Confidently address client concerns surrounding the impact of the proposed changes on finances and achieving goals

- Ensure plans presented are not overly optimistic once the new budget is passed

- Create more sustainable planning recommendations that may includes elements like insurance overage, sustainable spending, personal versus corporate asset ownership structures, capital gain crystallization decisions, etc.

Our dedicated team is thrilled to have been able to roll out this feature update so quickly to ensure our users have the tools and functionalities required to provide their clients with the best possible service and outcomes.

Stay tuned for updates!