As Seen On

Want to see Snap Projections in action?

Watch this 5-minute product demo.

Before & After Snap Projections

BEFORE

Wasted time

Are you wasting time with Excel or cumbersome, hard to use financial planning software to produce financial plans that are never read?

Confused clients

Are your clients confused by lengthy, complicated reports? Clients don’t read complex 50+ page reports. Their eyes glaze over.

Unengaged prospects

Are you failing to engage prospects and receive valuable referrals from clients? Unengaged prospects means no AUM growth.

AFTER

Hours saved every week

Create optimized financial plans and what-if scenarios quickly and efficiently. Reduce back-office time and save 5-10 hours per plan.

Increased client engagement

Use interactive presentations and easily present client projections to balance the level of detail so clients are engaged but not overwhelmed.

Growth in your AUM

Effortlessly generate high quality referrals from friends & family. Convert more prospects to clients and grow your practice.

Not ready to sign up for a free trial?

Request a demo and learn how to increase client satisfaction, save time and generate more referrals.

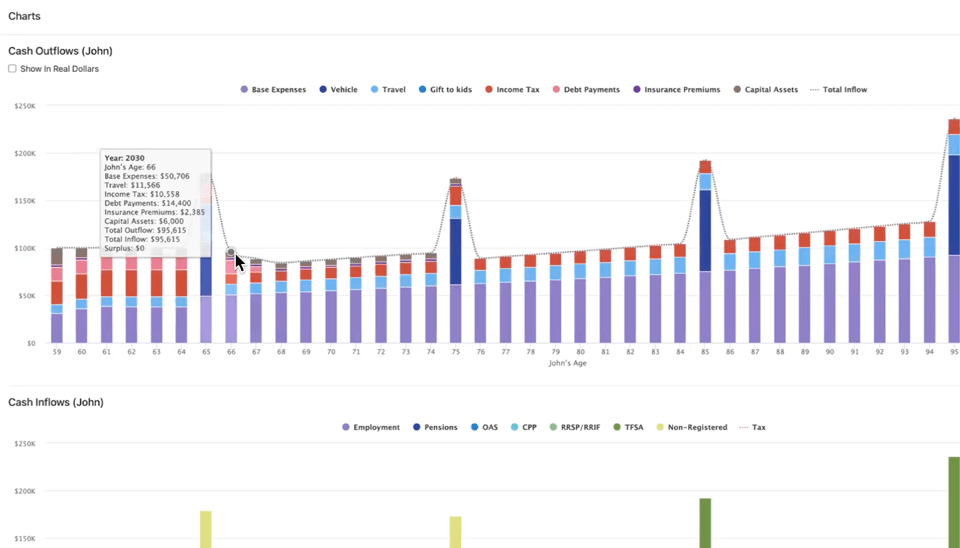

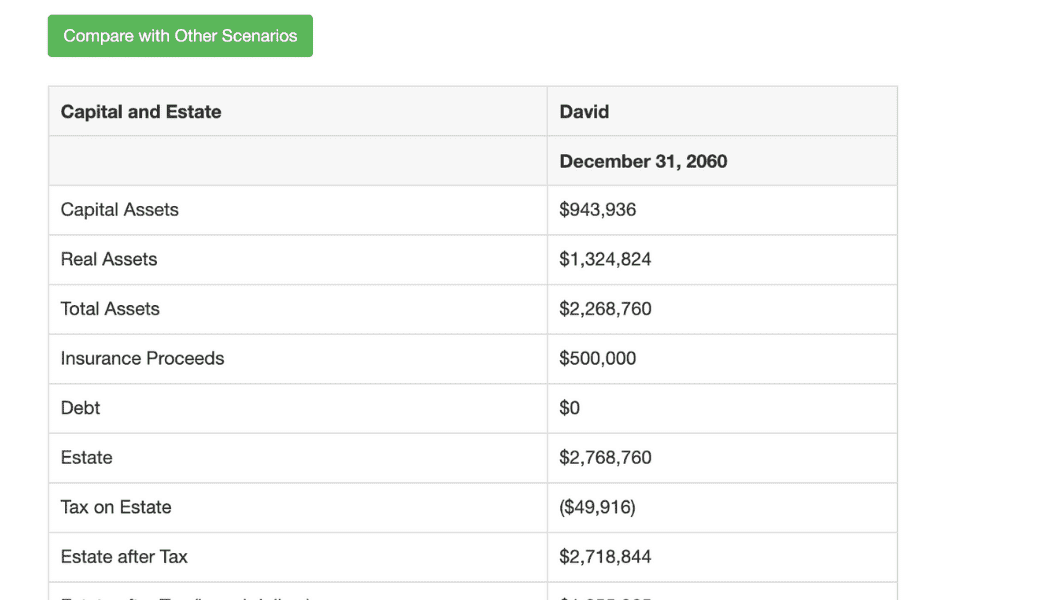

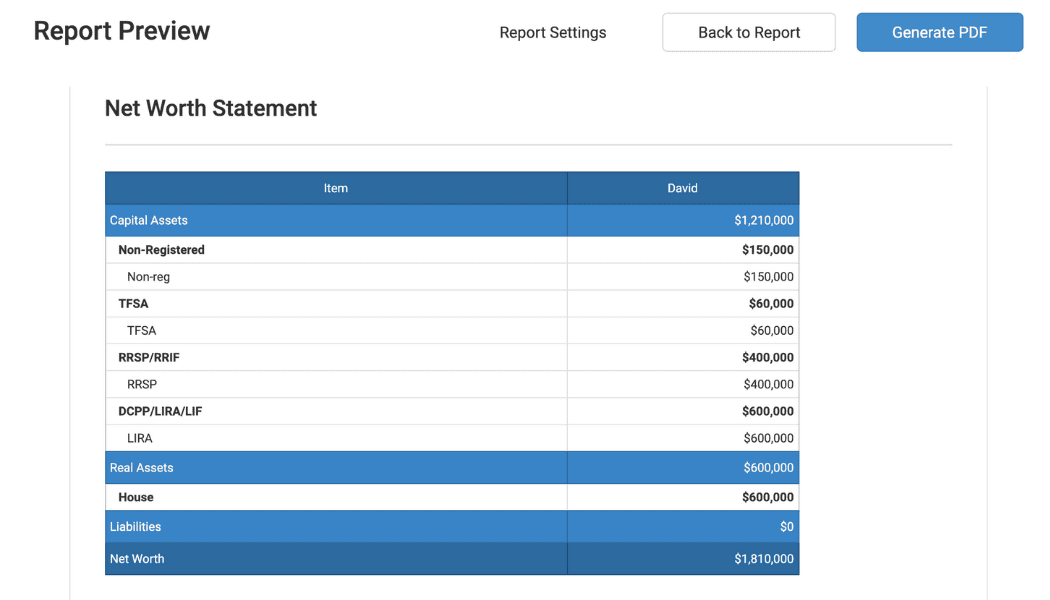

Expenses Module for goals-based planning

Leverage improved interactive charts and presentations to help educate your clients and show them without a doubt how the plan will ensure their goals are met. The new Expenses Module provides a transparent and highly customizable financial planning experience.

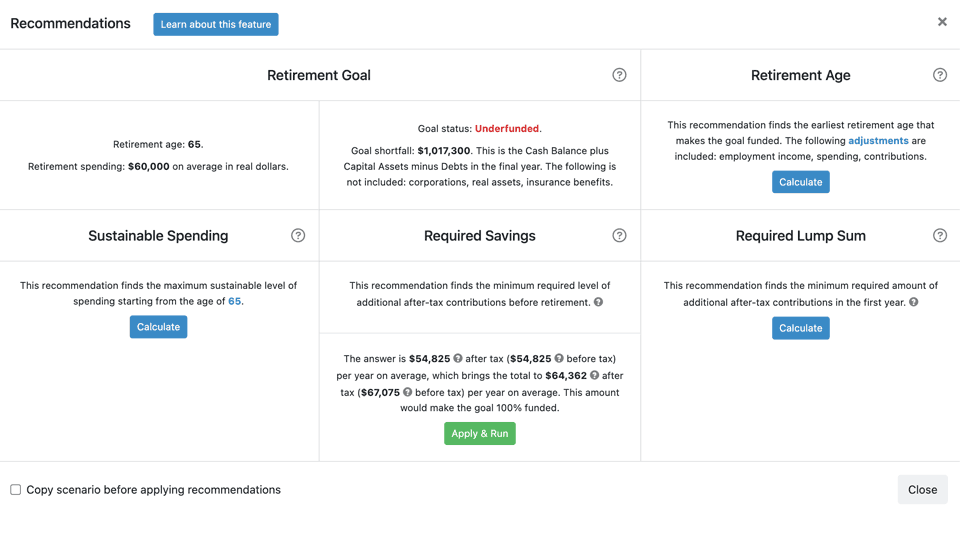

Provide your clients personalized recommendations

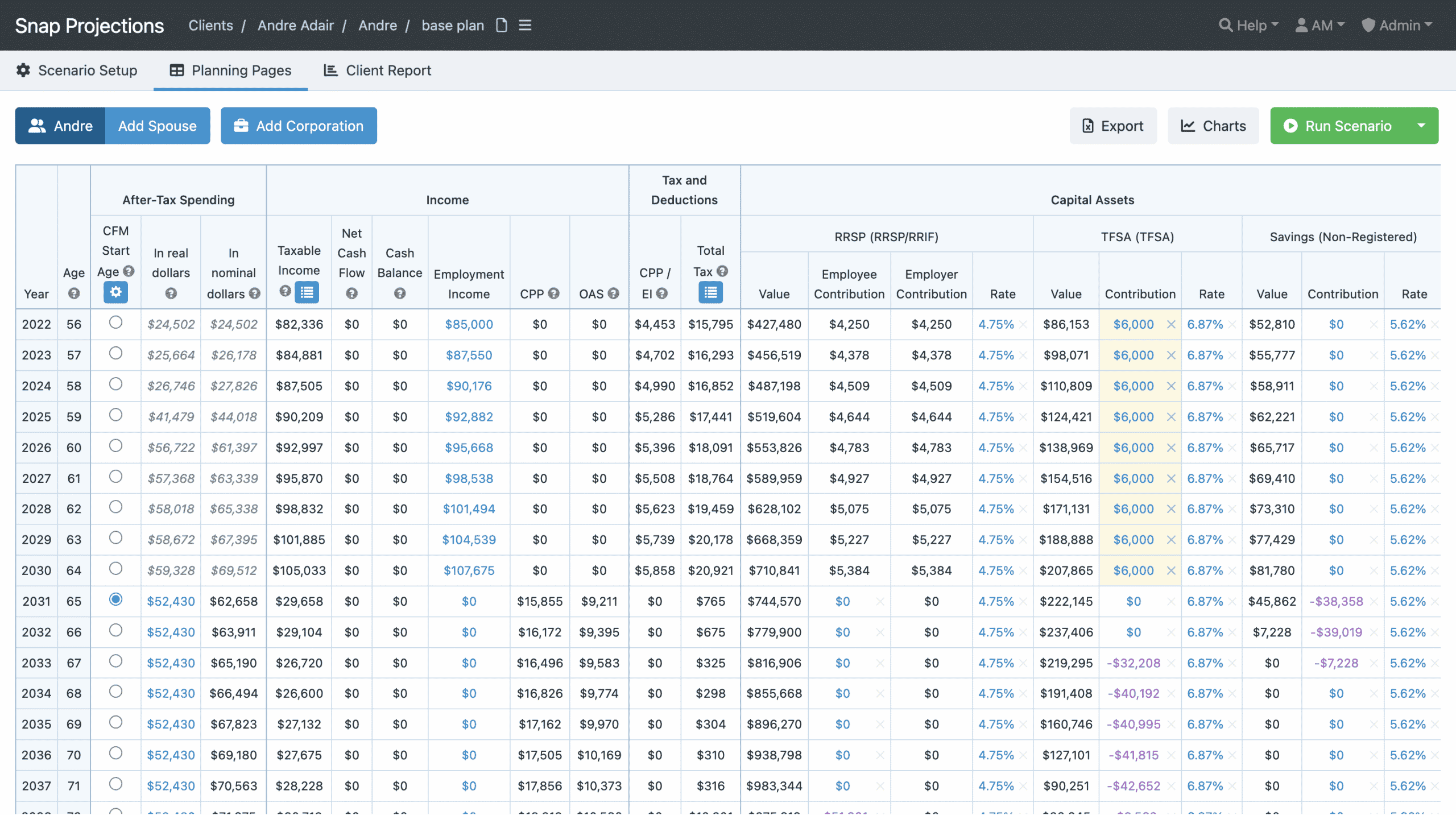

Show your clients their whole life on one page

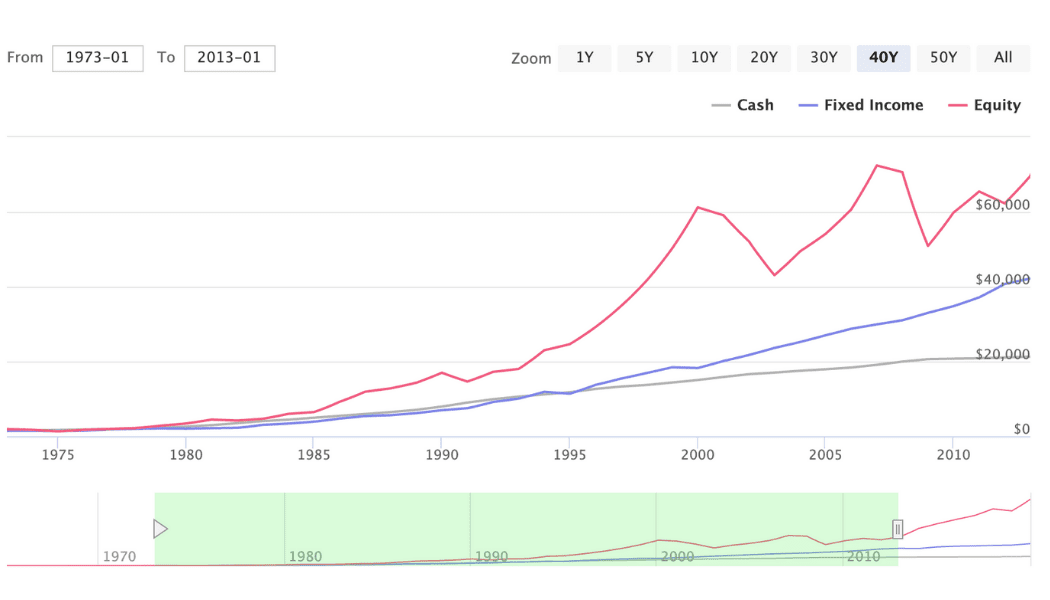

Stress Test projections and investment returns

Create optimized projections in minutes

Instantly compare scenarios

Create professional client-friendly reports

What Financial Advisors & Planners are saying about Snap Projections

“As a physician turned financial planner, I am well-acquainted with the frustrations and bad outcomes that can result from software that doesn’t perform well when you need it. My experience with Snap has been exactly the opposite. Even as a beginner, I was up and running after just a few practice scenarios.

Matt Poyner

Financial Planner

“I will vouch: the client service is stellar from Snap Projections. I submitted a case consult request and had someone on the phone within 15 minutes to resolve it! When one submits an online support request, there’s sort of an expectation that someone will get back to you within a couple of business days, but Snap is so responsive.”

Kelsey Smart, CFP

Principal, Smart Investments

“Snap Projections has the best support system of any Financial Planning software that I have used and I must have used nearly 10 of them. Snap’s support is far superior, providing quick and helpful support. For example, with another provider, I would have to set up support calls a day in advance but with Snap I really like the ability to call in and get help right away.”

Margaret Richards, CFP

Richards Financial

NEW

The Financial Advisor’s Marketing Guide

Learn how to build an online presence, create and share valuable content, and engage with prospects and clients through email marketing.