When Financial Advisors possess the skills to effectively present a financial plan, they can successfully engage clients in the financial planning process and cultivate long-term relationships. This is an important part of the process but something many Advisors tell us they struggle with — because presenting a financial plan goes far beyond simply presenting the numbers.

Financial Advisors and Planners must find ways to ensure that clients feel involved — after all, is it their plan. As a seasoned Financial Advisor, you already know this is easier said than done. To get that buy-in and engagement, you also need to ensure your clients can truly understand your recommendations while simultaneously navigating any potential negative emotions and motivating them to take necessary actions.

Why delivering a financial plan that your client can genuinely understand is so important:

Clarity and comprehension: Financial matters can be complex and even intimidating for some. By presenting information in a clear and understandable manner, Advisors help clients grasp the details of their financial plans. When clients have a solid understanding of the plan, they can make informed decisions and actively participate in the planning process.

Trust and confidence: When clients can easily comprehend the presented information, they develop trust and confidence in their Advisor’s expertise. Clear communication helps build a strong relationship based on transparency, which is crucial for long-term partnerships. Clients need to feel assured that their Advisor has their best interests at heart and is working in their favour.

Informed decision-making: When clients understand the recommendations and strategies outlined in the financial plan, they can make more informed decisions about their financial future. They can assess the potential risks, benefits, and trade-offs associated with different choices, allowing them to align their financial goals with their personal values and priorities.

Implementation and follow-through: A clear and understandable presentation increases the likelihood of successful plan implementation. Clients who comprehend the plan are more likely to take the necessary steps and make the required changes to achieve their financial objectives. When clients have a clear understanding of what needs to be done, they are empowered to take action and stay committed to the plan.

If you want to level-up your financial plan presentations and increase client engagement with plans and presentations that are truly understood, here are some tried-and-true techniques for Financial Advisors.

Download your free digital marketing guide for Canadian Financial Advisors, Planners, and Investment Managers here.

Start with your client’s goals & address their “why” throughout the entire process.

By summarizing the client’s goals at the outset of the meeting, you can effectively align your recommendations with their specific needs and provide suitable solutions. This may seem obvious but it’s one that can be forgotten or missed as long-term relationships are developed. Continuing to highlight the goals and objectives will remind your client of their why, but also ensure that as things change, as life happens, those goals are being adjusted and modified accordingly.

Ensuring that your clients feel genuinely listened to is of utmost importance. Otherwise, they may perceive that your recommendations are not tailored to their unique circumstances. If goals are out of date, the plan stops being relevant.

It’s important to revisit the underlying reasons, or the “why,” behind the financial plan you have created. What specific event or circumstance prompted them to seek your advice initially? What are their aspirations and objectives now, and in the future?

By tackling these questions, you can really connect with your client on a personal level. It shows that you truly understand where they’re coming from and how you’re actively working towards their goals through the financial plan.

Moreover, it’s important to address any specific concerns they’ve mentioned and offer potential ways to achieve success. This helps clients see the true worth of their plan and gets them excited about putting it into action.

In this Advisor Panel Discussion on building a thriving Advisory practice by leading with financial planning, the Advisors discuss the importance of those re-discovery meetings and finding opportunities as the relationship evolves.

Understand your client’s current financial situation.

This step serves to reassure the client that you have a comprehensive understanding of their financial circumstances. It also provides an opportunity to identify any missing information that may have been overlooked previously. By summarizing and updating their financial situation, you can promptly address any gaps and assess whether this new information necessitates adjustments to the plan. If anything has changed, which at some point it always does, this can help draw it out for discussion and consideration.

The Financial Plan Questionnaire available in this financial planning toolkit is extremely helpful to collect all relevant data and ensure nothing was missed. This questionnaire can also be used for those re-discovery meetings and plan updates.

Present and explain their financial plan in a personalized way with easy-to-understand charts and visuals.

When presenting your plan, it can be helpful to use simple language, especially with newer planning relationships, and avoid delving into complex discussions about the calculations. While this may seem obvious, it holds significant importance as it paves the way for clients to listen, learn, and effectively implement their plan.

However, as you continue to get to know your client on a more personal level, it will become clear how this particular individual thinks and absorbs information. For some clients, you may learn it is best to keep things simple. For other clients, this won’t be enough and you will need to tailor your presentation style to align with providing the information you know they want.

When clients really grasp your recommendations, the reasons behind them, and the steps they need to take, it boosts their confidence in taking action on their own. By educating them and helping them understand, they’ll be more likely to make smart financial decisions going forward and stick with their new plan.

To make sure clients really get it, give them enough time to ask questions during your presentations. It’s easy to get caught up in sharing your plan, but don’t forget to encourage clients to share their thoughts too. Their questions and concerns add a personal touch to their plan and get them more invested in the whole planning process.

Remember, effective communication means adapting your message to your audience. That’s the only way to ensure they truly understand, which in turn creates engagement and gets them on board with the plan.

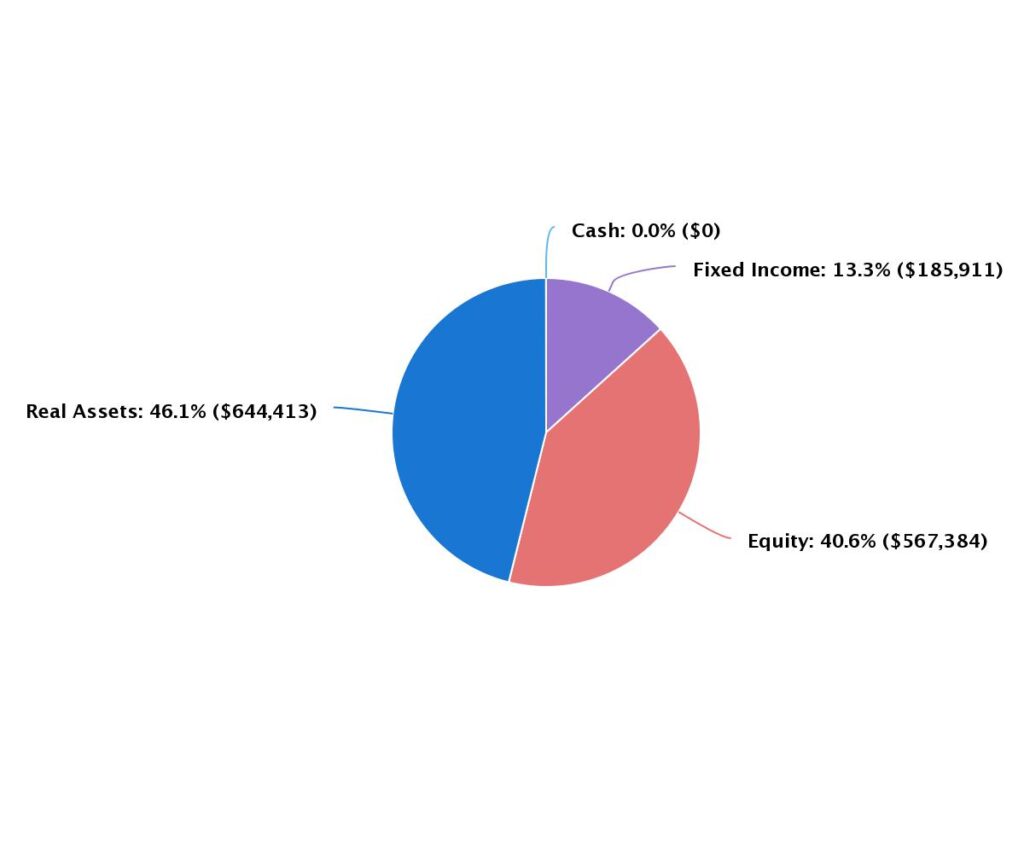

When conveying the results, opt for simple charts and graphs.

These charts should:

- Address your clients’ most important questions and concerns.

- Illustrate the client’s assets and their evolution over time.

- Demonstrate how the plan will ensure the client meets their specific goals and objectives.

- Provide a clear conclusion by presenting the necessary solutions and strategies for the client to achieve their retirement objective. This may involve reviewing the retirement age, reducing the cost of living, increasing savings, and other relevant measures — more on this subject is coming up in the next section.

Examples of impactful & effective charts your clients will be able to understand:

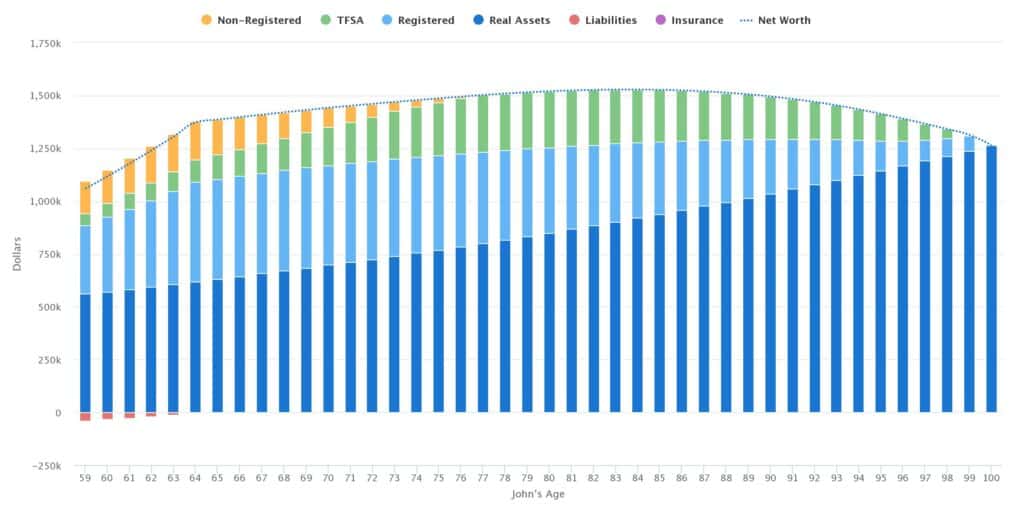

Net Worth Chart from Snap Projections

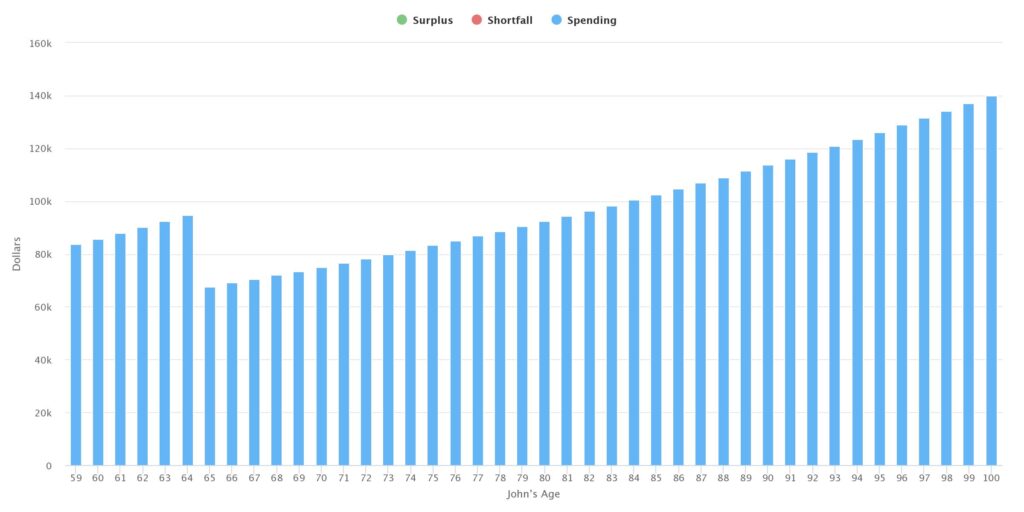

After-Tax Spending Chart from Snap Projections

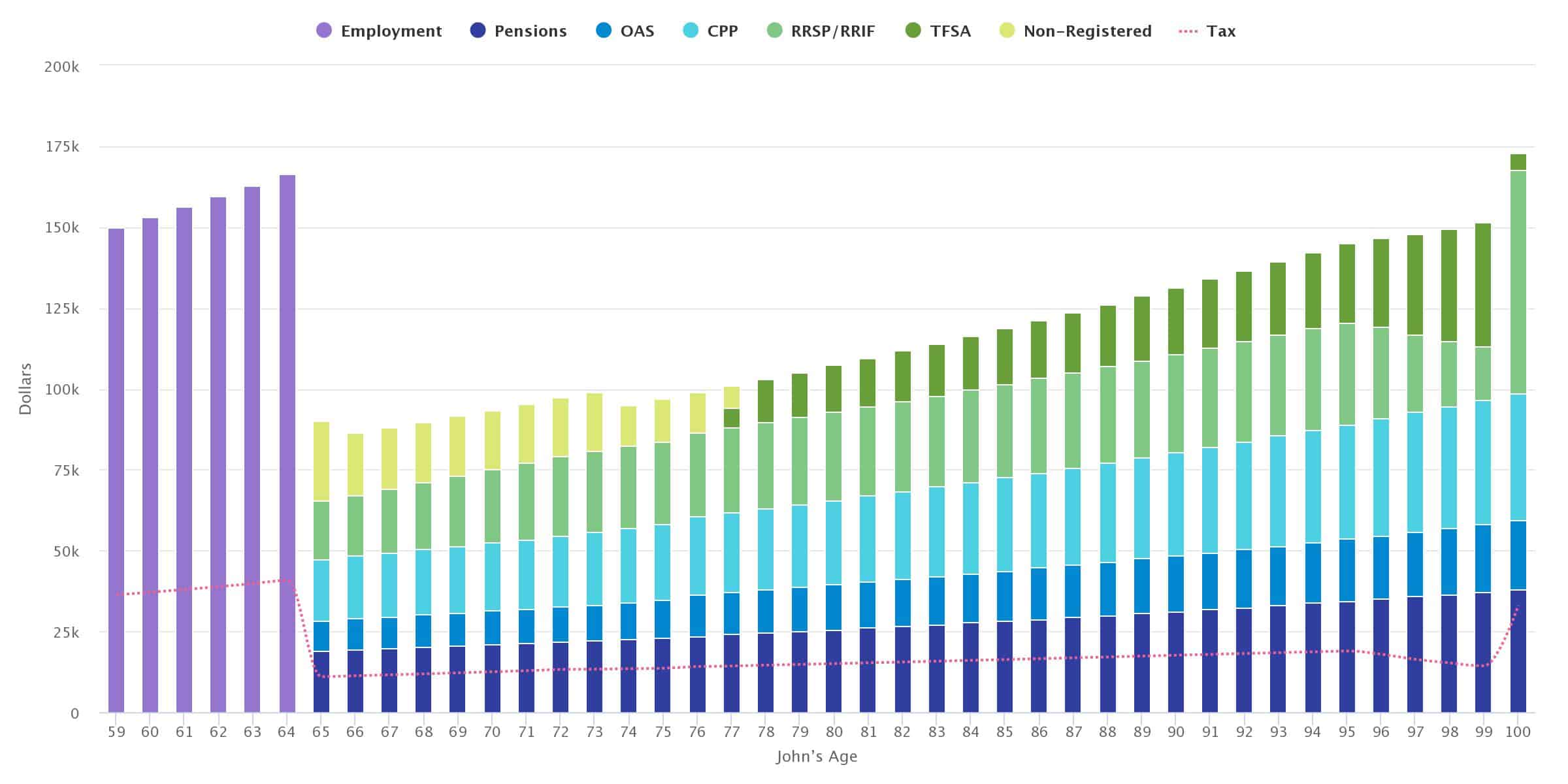

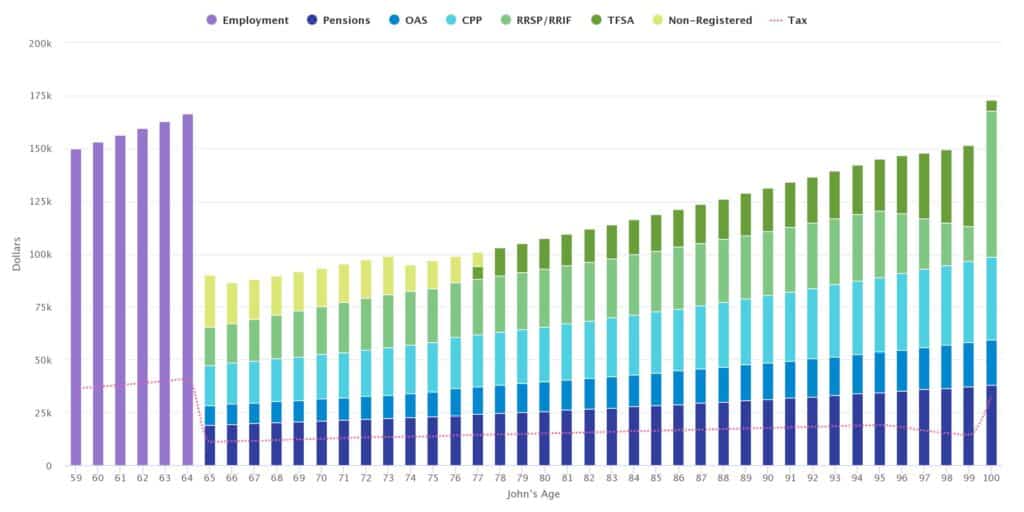

Sources of Income Chart from Snap Projections

Asset Mix Chart from Snap Projections

Present strategies, recommendations & proposed solutions that keep clients focused on their own goals.

Once you’ve laid out the client’s current situation, it’s time to prepare some recommendations and present practical solutions that align with their goals and objectives.

When it comes to recommendations, it’s important to keep in mind that they might require clients to make some changes in their behaviour. That’s why it’s wise to focus on a smaller set of recommendations, so you can really emphasize follow-through and boost the chances of successful implementation.

Try to personalize those recommendations to make them hit home for the client. Instead of just talking about how effective RESPs (Registered Education Savings Plans) are for financing a child’s education, bring it to life by speaking their language — explain how this mechanism may be the solution to pay for little David’s dream of attending Law School. That extra touch of personalization really helps the client connect on a deeper level and truly grasp the significance of the recommendations.

Incorporating real-time visualizations and illustrating “what-if” scenarios during your presentations will keep your clients engaged and can even get them excited about the process, prompting new questions and ideas. This interactive approach to presenting helps clients to understand which goals are realistic and see for themselves which potential paths may be more optimal than others, further reinforcing their understanding and commitment to the financial planning process.

Let’s see this in action!

In the video below, you can see how the same charts pictured above were created. You will see multiple “what-if” scenarios modelled in real-time.

For this case, we are modelling a retirement income plan for 59-year-old John Snapper. John plans to retire when he is sixty-five years old. As you will see in the video, his employment income will continue until that point, when he will start with his Defined Benefit Pension Plan as well as drawing from his personal assets. When he retires, he’d like to spend $62,000 per year, indexed to inflation. In the initial projection, he is running into a shortfall during his ninety-fifth year, as all his capital assets have been depleted. The charts will be used to explain this to John.

Moving forward from the initial projection that shows John running out of money, we can now move into the real-time Recommendations phase.

We can start with running the Sustainable Spending calculator to determine how much John can afford to spend if nothing else changes. We can almost instantly see how much he can afford to spend, if we want to ensure he has enough money to last until he is one hundred years of age. In this case, it’s $59,703 after-taxes, indexed for inflation. We can then access the charts again, and see what this updated plan plays out.

John would like to explore options to maintain his spending, so we can keep going. Next, we will model what it would look like if John chose to sell his home to fund that increased spending. We can plan to sell the home when he is eighty-five, investing the proceeds of the sale, which will roll into his spending. Additionally, we will need to consider the increased expense he will incur to either rent or cover the cost of long-term care. When he turns eighty-five, we can increase his annual spending from $62,000 to $90,000, indexed to inflation, and then see what that looks like. Does he have enough to maintain this? Watch the video to find out!

Effectively communicating complex financial information to clients is essential for ensuring their understanding and engagement. These interactive charts offer an innovative solution for visually presenting financial journeys in a simple and captivating way.

Key features to watch for in a financial planning software if you want charts that will be interactive, engaging, and easy-to-understand for your clients:

Engaging Financial Storytelling: Snap’s visually captivating charts enable Advisors to convey a compelling narrative, enabling clients to quickly grasp essential information. For example, the Sources of Income chart effectively illustrates the origins of income during retirement, providing a clear understanding of the financial journey ahead.

Mouse-over Pop-up Windows: By hovering the mouse over chart content, Snap’s pop-up summaries are triggered, offering a convenient way to highlight specific milestones or changes in a client’s financial situation over time. This feature is especially useful in the Net Worth chart, allowing advisors to emphasize significant events or fluctuations, enhancing client comprehension.

Customizable Display: Snap’s interactive charts provide flexibility in choosing what to display. Advisors can easily remove or add items by clicking on their names in the chart’s legend. Alternatively, hovering over an item’s name highlights it within the chart. This functionality empowers advisors to focus on specific incomes or assets, facilitating more personalized and comprehensive conversations tailored to each client’s unique needs.

Full-Screen View and Print Options: Snap’s interactive charts can be viewed in full-screen mode, allowing Advisors to present information in a visually impactful manner. Additionally, the ability to print individual charts offers the flexibility to create customized physical materials for clients. By adapting the presentation format, Financial Advisors can ensure optimal communication based on their client’s preferences and requirements.

Delivering presentations that clients can understand is vital for building trust, promoting informed decision-making, and ensuring successful plan implementation. It allows clients to actively engage in the planning process, make sound financial choices, and ultimately work towards their financial goals with confidence.