Corporate-owned life insurance can be used as a tool not only to build wealth, but as an effective way to tax-efficiently transfer that wealth to beneficiaries.

Corporately-owned life insurance policies can provide numerous benefits to business owners, aside from the obvious financial benefit in the event that an insured person passes away. Tax wise, there can be numerous advantages — this is all relative to specific cases of course, hence the importance of seeking out personalized financial advice before making decisions.

Today, we are going to explore one specific case where the purchase of a corporately-owned life insurance policy resulted in one couple’s after-tax estate value increasing by over $600,000.00.

We are going to start by walking you through a basic profile set-up in Snap Projections. Our Case Study couple, Alice and Marco Lee, reside in Ontario and are both currently 62 years old. They both plan to retire at 65. Once we create their base personal plan, we will build on their corporation and model the purchase of corporately-owned life insurance. We will then be able to compare the two scenarios, side by side, to see the impact of both potential paths.

Their personal details include:

Alice

- Salary of $105,000

- Assets

- Non-reg $50,000; 40% Fixed and 60% Equity

- TFSA $80,000; 40% Fixed and 60% Equity

- DCPP $330,000; 30% Fixed and 70% Equity

Marco

- Salary of $90,000

- Assets

- Non-reg $25,000; 40% Fixed and 60% Equity

- TFSA $80,000; 40% Fixed and 60% Equity

- RRSP $220,000; 30% Fixed and 70% Equity

Joint

- Home currently valued at $800,000 with a cost of $550,000 that will appreciate at 2.10%

As Steve sets up the profile, he will explain what assumptions Snap uses for inflation rates and rates of return, and demonstrate how to set-up income streams as well as both capital and real assets for both spouses. He will review debts, government benefits, as well as personal insurance options. Each individual spouse will have their own individual page, with the combined plan resulting in a third page view for the couple.

Once the base plan is set-up, we can review the projections in their entirety from the main planning pages. With Snap, you can show your clients their whole life on one page. Steve can quickly access each individual’s plan to build in changes, such as raises and RRSP contributions, right from the main planning page. On the combined page, we can review their after-tax spending projections for the duration of the projections.

From the main planning page, Steve will build in an indexed raise for Marco to match inflation, as well as annual TFSA and RRSP contributions of $6,500 and $10,000, respectively. Similarly, Alice’s salary will be indexed with inflation and she will invest the same amount into her TFSA until she retires.

Download your free digital marketing guide for Canadian Financial Advisors, Planners, and Investment Managers here.

In this case, Alice and Marco want to have access to a combined spending total of $105,000 after taxes, adjusted for inflation, throughout retirement. They intend to retire at age 65, and once we enter that into Snap and click “Run Scenario”, we can quickly see that they are on track to run out of funds at age 76 if nothing changes.

But, we have not added in their corporation yet, so let’s proceed.

Steve can easily set-up the jointly owned corporation and he will walk through the steps to enter the Holding Company.

Corporation data entry

- Name: Holding Company

- Province: Ontario

- Small Business Deduction

- Federal limit: $500,000

- Provincial limit: $500,000

- Refundable Dividend Tax On Hand (RDTOH)

- Non-Eligible RDTOH Balance: $50,000

- Eligible RDTOH Balance: $0

- Capital Dividend Account

- CDA Balance: $25,000

- Automatic Dividend Threshold: N/A

- General Rate Income Pool

- Grip Balance: $0

- Ownership

- Marco: 50%

- Alice: 50%

- Other: 0%

- Disposition

- Method: Winding-up

- Adjusted Cost Base: $0

- Paid-Up Capital: $0

- Assets

- Investments of $2,000,000 with cost of $1,750,000; 40% Fixed and 60% Equity

As Steve shows in the video, feel free to utilize Snap’s Long Financial Planning Questionnaire as a resource to help gather the corporate data from your clients.

Your disposition options in Snap Projections:

You can select either Winding-up or Share sale, with Winding-up being the system default.

Winding-up is required in order to model corporately-owned life insurance and as such is the assumption during set-up. This method assumes that the corporation’s assets are liquidated and taxes are paid, debts are repaid, and any insurance proceeds are received. Then the cash is distributed to the estate through a combination of Capital Dividends, Eligible Dividends, Non-Eligible Dividends, and Return of Capital. The estate will pay a combination of capital gains taxes and taxes on dividends.

Share sale, conversely, assumes that the estate sells the corporate shares for the Net Worth of the corporation at the end of the final year of the projection. The estate will pay capital gains taxes based on the Net Worth of the corporation less the ACB of the corporate shares.

Moving ahead, we can add any required assets and investments before proceeding back to the planning page for the corporation. We can enter the amount of dividends they plan to take out — in this case it is $25,000 of non-eligible dividends starting at age 65 for both Marco and Alice. We can index those at the rate of inflation to increase that over time and run that until the end of the projections at age 100.

We can see that Snap is doing the heavy lifting here to account for these withdrawals, and we can see the proper taxation implications as well. We can see what is expected to be left in the corporation at the end of the projections with this dividend level. When we return to the personal page, we now have a blended view of the personal financial plan that shows the corporate income flows and values. In this case, we can see that the increase in dividend income more than meets Alice and Marco’s spending target of $105,000 annually throughout retirement. In this case, we can see that personally, in addition to the $2.4M that is left in the corporation, their capital asset balances are still expected to be about $869,000.

As Steve reviews the interactive charts, we can get a visual of what this looks like which helps to explain how all of this is going to work to our clients.

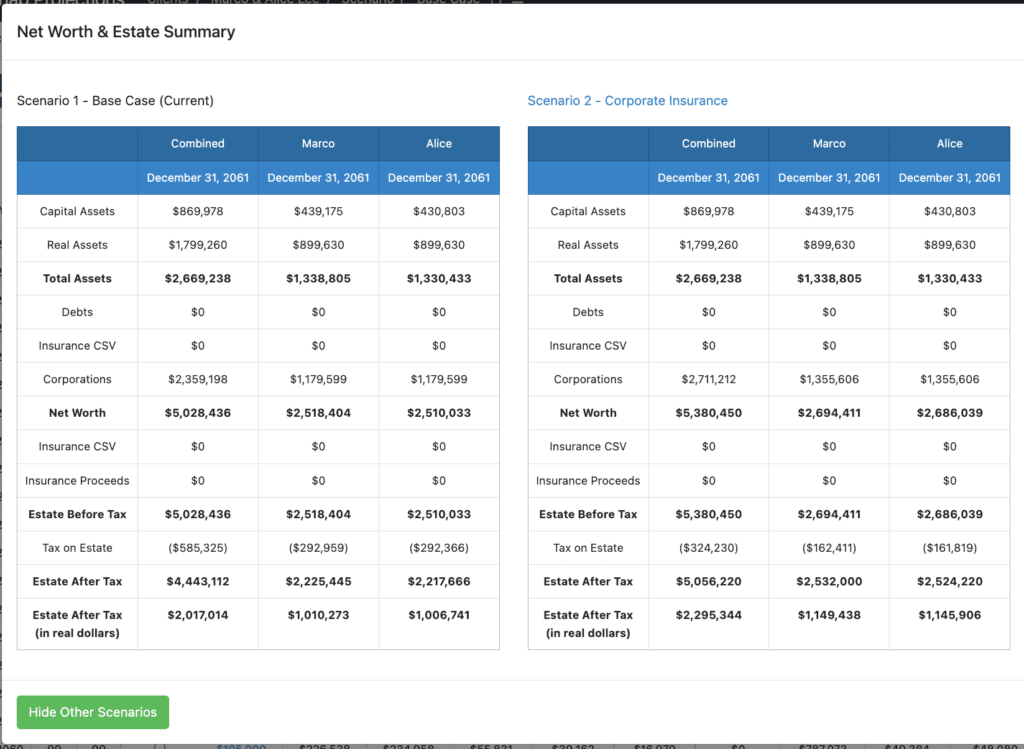

Then, we can review the Net Worth & Estate Summary to see a more detailed breakdown of the corporate net worth disposition. Remember, we did have the option to select either the wind-up or share sell method when setting this up. All of this, along with the additional personal and taxation components outlined within the summary, results in the expected total combined Estate Before Tax value of just over $5M.

With so much excess cash being left in the plan beyond what they need, Alice and Marco are left wondering if there may be a more efficient way to pass some of this wealth on to their beneficiaries.

Enter into the discussion corporately-owned life insurance.

We’re now going to build out a second plan which will explore adding corporate insurance. Steve can easily add in a life insurance policy that is corporately owned, simply copying and pasting the values into the software directly from the quote provider’s illustration (that has been provided in spreadsheet form). With a few clicks, we have built in the cash-surrender value, death benefit, adjusted cost base, and annual premiums. When we return to the planning pages, we can see how that policy now reflects in the projections.

We can see that the withdrawal from the corporate investment account has increased, as we’re now paying the premiums for this policy as well as income taxes. Once the dividend payment starts, we can see the withdrawals increase even more. Snap automates all these withdrawals accordingly. If we look ahead, we can see that now there is about $1.3M left in the corporate investment account where the previous projection shows about $2.4M. We have used up some of that money in the earlier stages to fund that insurance policy. Now, in the final year of the plan, we would expect to see about $1.4M paid out in the form of a death benefit and the cash-surrender value is about $963,000.

Steve explains the details of each element in the video, but the end result for this particular case is that when corporate insurance has been purchased, the combined net worth at the end of the projections is $5,380,450, which is $352,014 more when compared against the base case without insurance.

Next, we look at taxes owing on estate. With corporate insurance, final taxes on estate on December 31, 2061, are projected to be $324,230. In the scenario without corporate insurance, taxes on estate are expected to be $585,325. This means that purchasing the corporate life insurance has reduced estate taxes by $261,095.