CLICK HERE: Watch the clip and see how it’s done, live in action!

We recently surveyed Snap users to get a better understanding of how financial planning software has benefited and grown the financial advisory practice. The responses were meaningful and impactful – so much so that we wanted to put together essentially a guide for all Canadian Financial Advisors who seek to grow their practices through effective financial planning.

Let’s start with sharing just two of the survey questions we posed.

Question: What has been the most impactful use of Snap for your practice?

Top answers:

- Answering client questions.

- Providing peace of mind.

- Expanding the advisor and client relationship.

- Earning new clients.

Question: How was this achieved?

Top answers:

- Sustainable spending scenarios.

- Real-time adjustments to plans.

- Comparing scenarios.

- Charts.

And this got us thinking – if Snap users are using their planning software in very specific ways – not just to serve their clients but to grow their advisory practices – we should dig into that and see how this information can benefit all Financial Advisors.

The clip below is a piece of a training webinar that shows exactly how Advisors can run sustainable scenarios, make real-time adjustments to plans, compare scenarios, and use client-friendly and engaging charts to educate and help their clients.

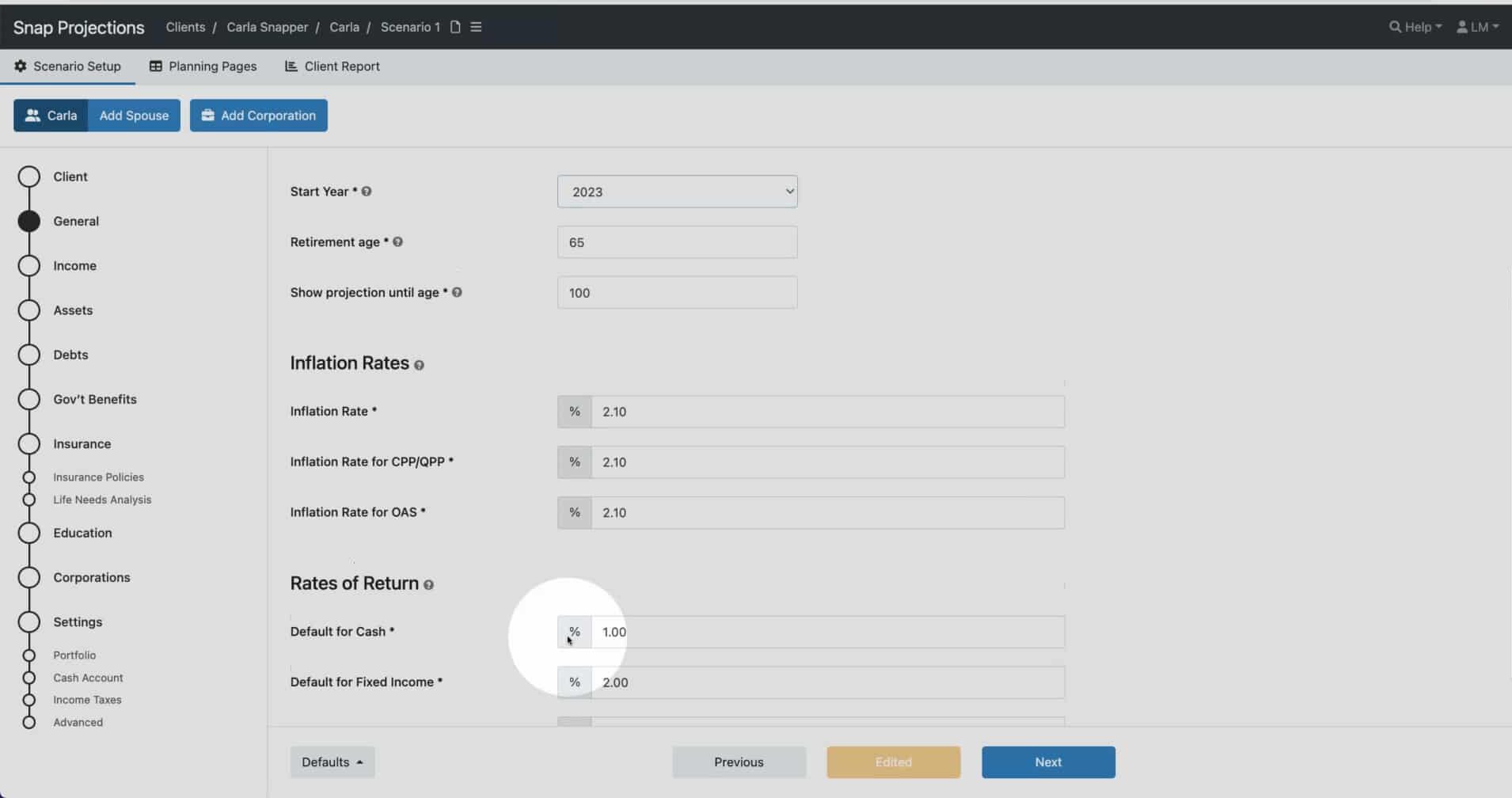

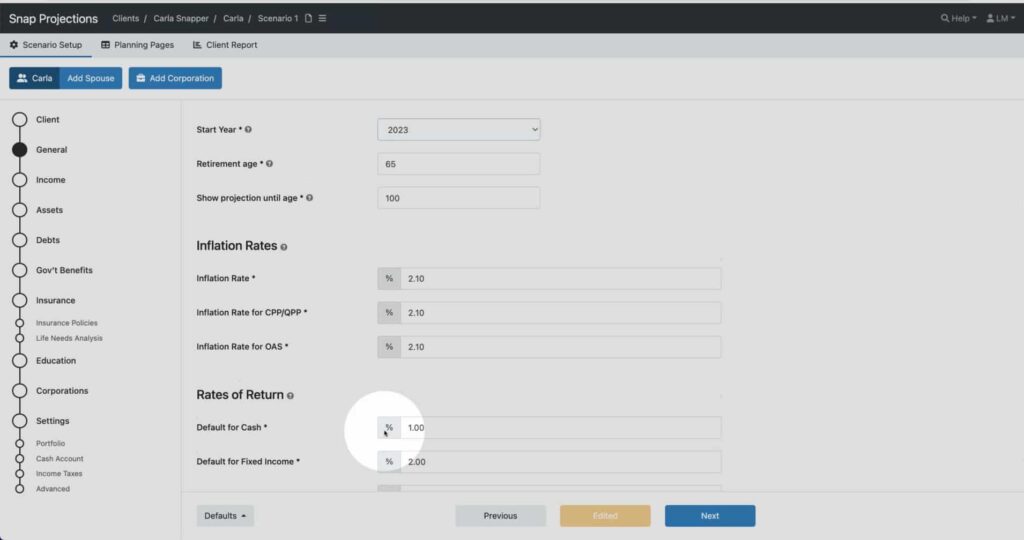

Let’s see this in action for Carla Snapper. During part of a training tutorial for Snap users, you can see how quickly Steve can create a profile in Snap, including data entry, in just minutes.

CLICK HERE: Watch the tutorial clip now.

Once the profile is set up:

- We can see Carla’s projections and determine whether or not she is currently on track to meet her desired after-tax spending goal in retirement.

- Once we determine her current state, we can see a pending shortfall.

- We can then create multiple what-if scenarios to recommend changes and optimize Carla’s plan, including the tax implications of contributing to her RRSP instead of the TFSA.

- We can see the impact making accelerated mortgage payments could have on her retirement plans.

- We can dig into Carla’s priorities to determine which are most important, and illustrate what changes we can make to achieve the most important goals.

- With just a few clicks, we can model what varying retirement start ages might look like.

- We can run the Sustainable spending calculator to show Carla how much she can afford to spend, if we want to stretch that capital all the way to the end of her projections.

Here are the top 4 ways we have found that Financial Advisors are using financial planning software to grow their advisory practices.

1. Convert prospects

2. Increase retention

3. Expand relationships

4. Generate referrals

Convert more prospects by showing them what it’s like to work with you before you ask them to work with you.

Snap users tell us that the software has become a crucial component of their prospecting process.

Once you’ve determined that the prospect is a good fit, you can easily (and on the fly) create a live plan in ten minutes or less. Setting up a new profile takes only moments, at which point you can demonstrate relevant strategies that may have impact. For example, figuring out how much to start saving or optimizing decumulation during retirement. You can quickly and effectively show potential clients what it’s like to work with you while simultaneously providing value before asking for anything in return.

You could also opt to create and save sample plans and projections for specific client cohorts. For example, pre-retirement, approaching retirement, and retired – you could have reports, charts, and answers prepared ahead of time within the software to show potential clients.

Increased retention happens naturally when clients see your value from each and every meeting.

When you have the ability to quickly create and compare various projections and recommendations for your clients, it’s a game changer for client retention. When you can address client questions, it demonstrates your value and shows the true impact of your relationship.

For example, with Snap, you can quickly build multiple what-if scenarios for your clients:

- Current state → what would happen on their current path?

- Recommended state → what additional actions and optimizations can we help them achieve?

- Stress tested plan → what would happen if life deviates from the plan, unexpectedly or intentionally?

-

- Returns are variable and/or lower than expected

- Income and savings are lower than expected

- Forced to take time off work

- One client passes away early

- Retire early

- Downsize family home at retirement

- When will the mortgage be paid off and what would it look like if we increased payments by $x/year?

- What happens if we contribute to the RRSP instead of the TFSA? What are the tax and long-term cash-flow implications in retirement?

Happy clients stay, so you want to ensure your financial planning process provides value at every opportunity.

Uncovering opportunities that support expanding the relationship can happen easily and should be ongoing.

Growing assets under management and increasing services with existing clients is a crucial component of client maintenance and retention – not to mention an easy way to grow your practice and ensure your clients’ needs continue to be met. A financial plan is a living, breathing thing for a reason – things change, people change, goals change. Relationships are dynamic and ensuring you can continue to uncover needs is in your clients’ best interest.

Quick scenarios that can be modelled in Snap include:

- Benefits of consolidating assets → model cash wedges, de-risking the portfolio, etc. Additionally, there’s an opportunity to talk about drawdown strategies and how in retirement you’ll have a chance to optimize between different accounts, timing, conversions, and more. Plus, it’s more effective if you both have full control over those timings together at one place.

- Estate planning → will there be enough left for dependents? If not, should we run a life needs analysis?

- Risk planning → what happens if one spouse loses their income? What would the impact on retirement be if contributions stopped or funds had to be accessed early? What gaps exist in the plan, and what does it look like if the worst case happens?

Asking for referrals will never feel icky when you know your service as a Financial Advisor is top notch.

Generating referrals is an important aspect of building a sustainable financial advisory practice, but many Advisors tell us they do struggle when it comes to asking for them. Luckily, your excellent service will often result in referrals whether you request them or not. But imagine a scenario where every client is overjoyed with your level of service, and then every client is asked if they have friends or family with the same questions or concerns that you could help?

Many Advisors who use Snap have seen a direct increase in the number of referrals they’ve received since switching financial planning software. Timing is important because once you’ve given all this value, you can confidently prompt the idea in an authentic fashion that works.

You can get the full report from Snap user Renee Hawk below where she outlines how using Snap has resulted in regularly receiving 3x as many referrals as before.