We know that right now inflation, interest rates, talk of bear markets, and declining portfolio values are top of mind for nearly all Canadians — in particular, those who are either approaching retirement or are already there.

Our users have been telling us that they need more tools to facilitate these conversations in order to provide their clients with the peace of mind and level of service they need.

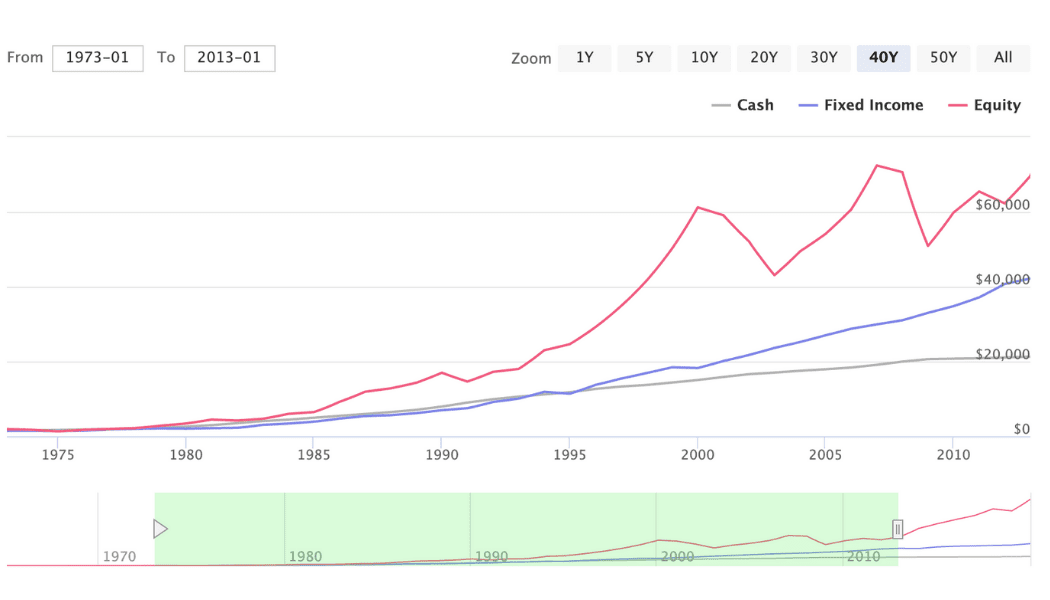

This is why we have recently built and released a brand new feature called Stress Testing. This feature is an add-on that allows you to apply historical or randomly generated rates of inflation and investment returns to your projections.

Stress tested projections aren’t meant to replace your original plans, so we always recommend starting with your base expected returns, and then making a copy to facilitate the stress testing discussion with your clients. When you’re having these types of discussions with your clients about what the sequence of returns risk is and how it may impact them, there are many variables to cover. We need to consider both sides of this – if we’re seeing negative returns during the contribution years, this will materially change the value of the portfolio come retirement time. If we’re seeing negative returns during the decumulation phase, perhaps we’re experiencing early market losses and later market gains, the portfolio may be depleting faster than expected.

There’s no way to know for sure how the sequence of returns risk could impact actual retirement portfolios, but we can model both randomized and historical data to get a good idea of potential outcomes.

You can watch a quick video overview on it here.

Why we created Stress Testing:

During the interview process, there was consensus among users that the current uncertain economic environment was a top concern for advisors and their clients. There was a clear appetite for tools that enable purposeful discussions about the downside risk that can impact the success of the client’s financial plan. The usefulness of modelling the variability of returns and ranges of outcomes was evident.

Download your free digital marketing guide for Canadian Financial Advisors, Planners, and Investment Managers here.

How Advisors tell us they plan to use this new tool:

There are plenty of use cases for the new stress testing tool, which provides both historical and randomized return options, but here are the most common ones:

- Show a range of potential future market returns and inflation rates so your client is comfortable with and prepared for more than a base case outcome. This can be combined by running a sustainable scenario to establish a more realistic after-tax spending target that considers the impact of lower than expected returns.

- Model sequence of returns risk to demonstrate that the timing of when your client receives strong or poor performance on their investments matters, in addition to their overall returns. For instance, you can model a period of negative returns following retirement to show that selling investments to fund withdrawals in a bear market can have significant and negative impacts on the client’s likelihood of success.

- Model strategies that can help minimize this risk such as a cash wedge or rebalancing into a more conservative asset allocation.

- Model the first two use cases mentioned above by using their own (or their firms’) market assumptions — think customizing expected returns and standard deviation — to show the potential impact on their projections in context with their investment portfolio assumptions. This is especially useful for planners that support portfolio manager types of advisors.

What current users of this new functionality are already saying:

Want to try it for yourself?

Sign-up for your 14-day free trial now and activate the Stress Testing feature. It’s free for 14 days, too!