Why Snap Projections is the leading RazorPlan alternative for Canadian Advisors

Streamline your process. Easily provide comprehensive personal & corporate financial planning with the flexibility your clients require.

Show your clients their whole life on one page with Snap Projections. It’s comprehensive yet easy to use.

Comparing Snap Projections to RazorPlan

Snap Projections |

RazorPlan |

|

| Create simple projections in 20 minutes or less | ✔ | ✔ |

| Scenario-specific Recommendations | ✔ | ✔ |

| Stress test your projections with historical or randomized returns | ✔ | ✔ |

| Retirement income planning | ✔ | ✔ |

| Enter multiple accounts of the same type (e.g. 2 or more RRSPs, TFSAs, LIRAs, Non-reg) | ✔ | |

| Ability to enter the actual withdrawal amounts for Non-Registerd, TFSA and LIFs. | ✔ | |

| Create multiple "what-if" scenarios for comparison | ✔ | ✔ |

| Modify scenario data (income, contributions, withdrawals, rates of return, etc.) from a single Planning Page | ✔ | |

| Client friendly reporting | ✔ | ✔ |

| Automated & fully optimized income splitting for every year of the projections | ✔ | |

| Ability to set custom asset allocation for individual accounts | ✔ | |

| Life insurance planning | ✔ | ✔ |

| Automatic Disability and CI insurance recommendations | ✔ | |

| Dedicated charitable donations module for cash, assets & insurance | ✔ | |

| Monthly & annual plans available | ✔ | ✔ |

| Enterprise capability | ✔ | ✔ |

| Data security & compliance | ✔ | ✔ |

See Why Advisors are Switching from RazorPlan to Snap Projections

“I’m really loving Snap! I was using Razor in the past, but really prefer Snap. I have a real mistrust of technology, and if I can’t see where the numbers are coming from, it makes me very uncomfortable. I am very impressed with how your program lays out the numbers, and how easy it is to make changes and double check for accuracy.”

“Snap has really streamlined my client conversations. With other software, I would have to collect the data, then need to take that back and work in the program on my own, and then have a 2nd meeting to present. I wasn’t able to work efficiently within the program to do it in front of a client. With Snap, the client and I can work together on the data, and get it all done in one appointment, cutting the number of meetings required in half. The process just simply flows better.”

As Seen On

Top 7 reasons Advisors choose Snap Projections over RazorPlan for their financial planning platform

Personal & Corporate Financial Planning all in one place

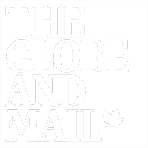

In this scenario, you can see the client’s personal and corporate financial projections (all in one place) from Snap’s Main Planning Page.

All Advisors have their own unique way of serving their clients and typically create their own process for financial planning that is optimized and enhanced over time. Ideally, Advisors want to work with financial planning software that can adapt to meet changing needs and one that continues to expand and learn, just as the practice does.

From start to finish, Snap supports the comprehensive personal and corporate financial planning process. With Snap, your entire financial planning process can be managed in one place. You’ll start with using the provided Financial Planning Questionnaire to both collect the information you need and engage in meaningful conversations with your clients. Using Snap, you’ll be able to plan for both the accumulation and decumulation stages of life, conduct tax and estate planning, comprehensive corporate planning, and more. You’ll then be able to utilize the Life Needs Analysis Tool to determine what level of life insurance coverage your client needs, based on their unique set of circumstances. Year over year, you’ll have a comprehensive plan that is easily adjusted and updated as necessary.

Advisors who have used Razor prior to switching to Snap tell us that throughout their process, they would use Razor to show their clients if they were on track for their retirement goals, and also provide a risk assessment report for insurance needs. Outside of that, they say they might supplement Razor with other tools for specific aspects of their planning, such as corporate and tax planning.

Advisors say that because Razor is meant to keep things simple and high-level, it often seems to lack the customization needed to satisfy all aspects of comprehensive personal and corporate financial planning. For example, Razor introduces the concept of Tax Efficiency for non-registered and corporate investments without providing the ability to enter the actual asset allocation for an account. They explain that they do this to minimize the complexity of the financial analysis while maintaining accurate tax calculations. While it is true that e.g. eliminating entering the asset allocation may simplify the process, it is a significant limitation.

Data entry, ease of use & getting help

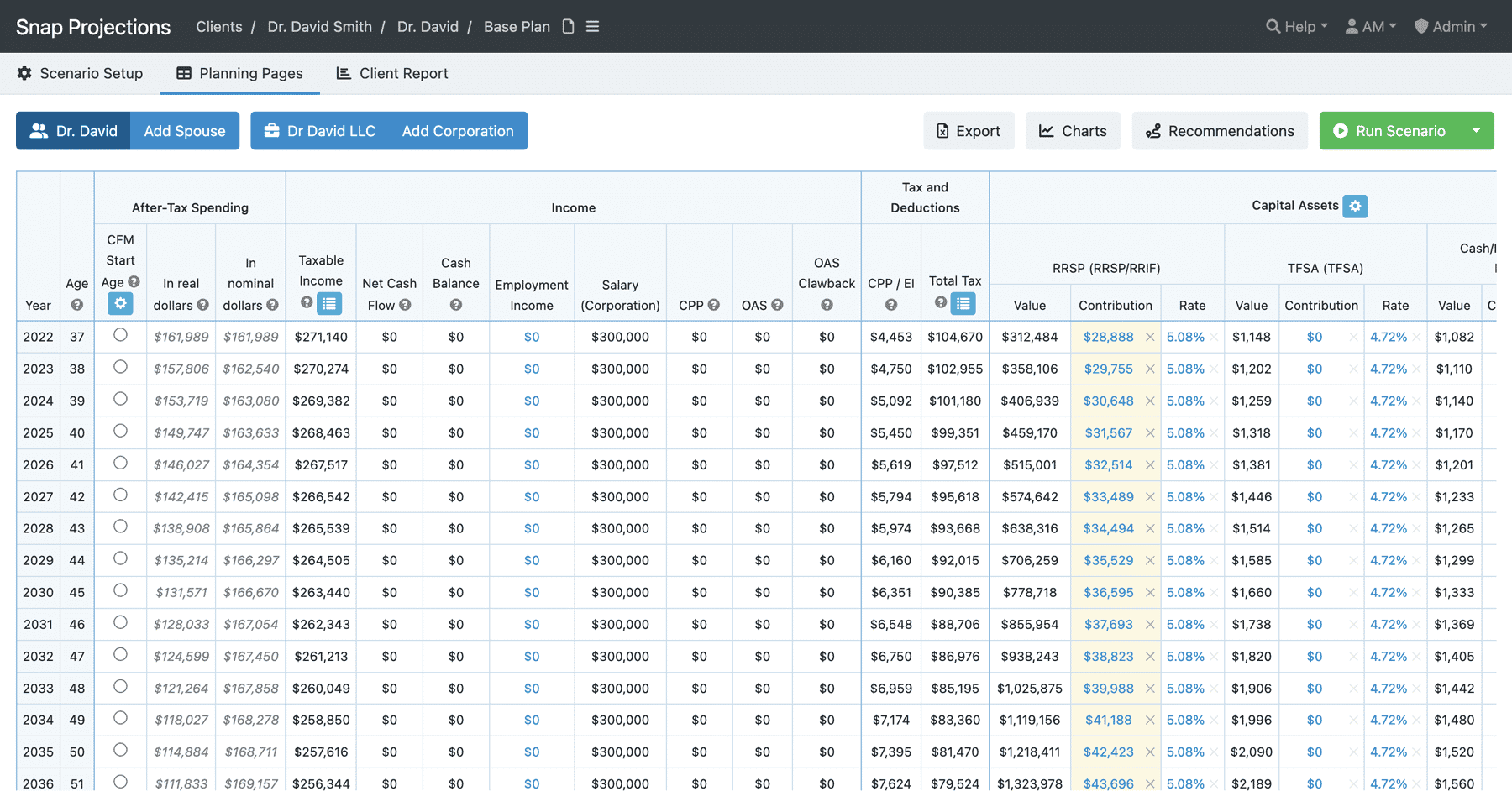

In Snap Projections, data entry is streamlined. You can enter asset accounts individually or you could choose to lump them together. You have both options available to you.

Advisors tell us that data entry is similar for both RazorPlan and Snap Projections, but there are some key differences which impact flow and ease of use. Both programs strive to keep things simple and straightforward for the Advisor, but Snap allows for more flexibility without becoming complicated. Razor appears to prioritize keeping things high-level and focusing on the bigger picture, but Advisors tell us that at a certain point that focus actually makes things like data entry and client conversations more difficult.

For example, when entering assets into Razor, you can only create one account per account type. This means that if your client has multiple RRSPs or TFSAs, they must be lumped together during the data entry process. While this may seem like a minor thing, it can become problematic in practice. It means that instead of quickly setting up your accounts, you’re pulling out the calculator to sum up the balances across all accounts. In addition, during the decumulation phase, you have no ability to make withdrawals from a specific account. If clients, for example, have multiple non-registered accounts and need to make withdrawals from one but not the other (e.g. for tax planning purposes), since that’s all been lumped together in Razor, you don’t have the ability to do that. Or, maybe there’s an Employer Group RRSP and an individual one. In both cases, trying to keep it simple by lumping the assets together actually complicates things during data entry and the decumulation, creating additional complexities that have to be explained to your client.

In Snap, you can enter accounts individually with as much or as little detail as you like, or you could choose to lump them together. You have both options available to you.

Razor and Snap both allow you to create a base plan fairly quickly, but some Advisors say it takes longer in Razor to get that initial set-up because the data entry flow isn’t as streamlined or intuitive.

Advisors tell us that with Snap, data entry remains both simple yet flexible. They say you can take notes from a short conversation with your client, put the information into Snap, and start developing a meaningful base plan with an option to add more detail at a later stage. The flow of the information goes into the software in the same natural order that you would have a conversation, meaning you can easily do it with a client present. For more complex cases, you can use Snap’s Financial Planning Questionnaire to collect the data beforehand, work on the plan yourself, and then present & share it with your client afterwards.

In addition to entering the data with ease, the other big thing here is the time savings. Advisors tell us that the ease of data entry and accessible main planning page are what streamline their client conversations and eliminate time spent accessing multiple ledgers within Razor. Obviously when things can be done easier they can typically be done faster, but there is more to it than just that.

Some Advisors who use Snap use it with their clients present, which is something our former Razor users tell us they would never have done before switching. When you’re sitting with a client, the flow of data entry has to make sense and be streamlined, otherwise you will lose that engagement from the client.

The reality for Advisors who use Snap is that they can have a client conversation, spend 20 minutes working in Snap, and create a base plan that will act as a starting point of how they’ll move forward. When using Razor, those same Advisors say they would collect the information from their clients in an initial meeting, go back to work in the program, and then schedule a second meeting to discuss. Any further changes or scenarios would require additional meetings. With a new client or prospect, Advisors tell us they can achieve the same result in one meeting using Snap versus two meetings when previously using Razor. This means that by switching from Razor to Snap, our users have cut those meeting times in half.

Another component related to ease of use is transparency — simply being able to tell where the numbers have come from. Because Snap provides a succinct main planning page with all settings easily accessible, it is not difficult to understand how a particular figure was generated. With Razor, Advisors tell us that’s not the case. They say that you can get into the back-end of Razor if you want to, but that it can be quite challenging to find out what it’s telling you and determine where certain outputs are coming from. If you’re working on the plan in the morning with a client meeting scheduled that afternoon, this can become problematic.

Snap Projections provides 1:1 support via the phone and email Monday through Friday, 9am to 6pm ET. The Snap team understands that when you need help, you need it now — not tomorrow. Highly trained customer support staff are quick to respond and resolve any issues, and screen-share for the best possible experience and quickest resolution. They host training webinars regularly, have drop-in sessions, and have a dedicated 1:1 Onboarding & Training process. All aspects of the Snap Projections software are covered under the support policy, and there are additional resources provided such as how to best present your plan to clients, client-facing documents, and more.

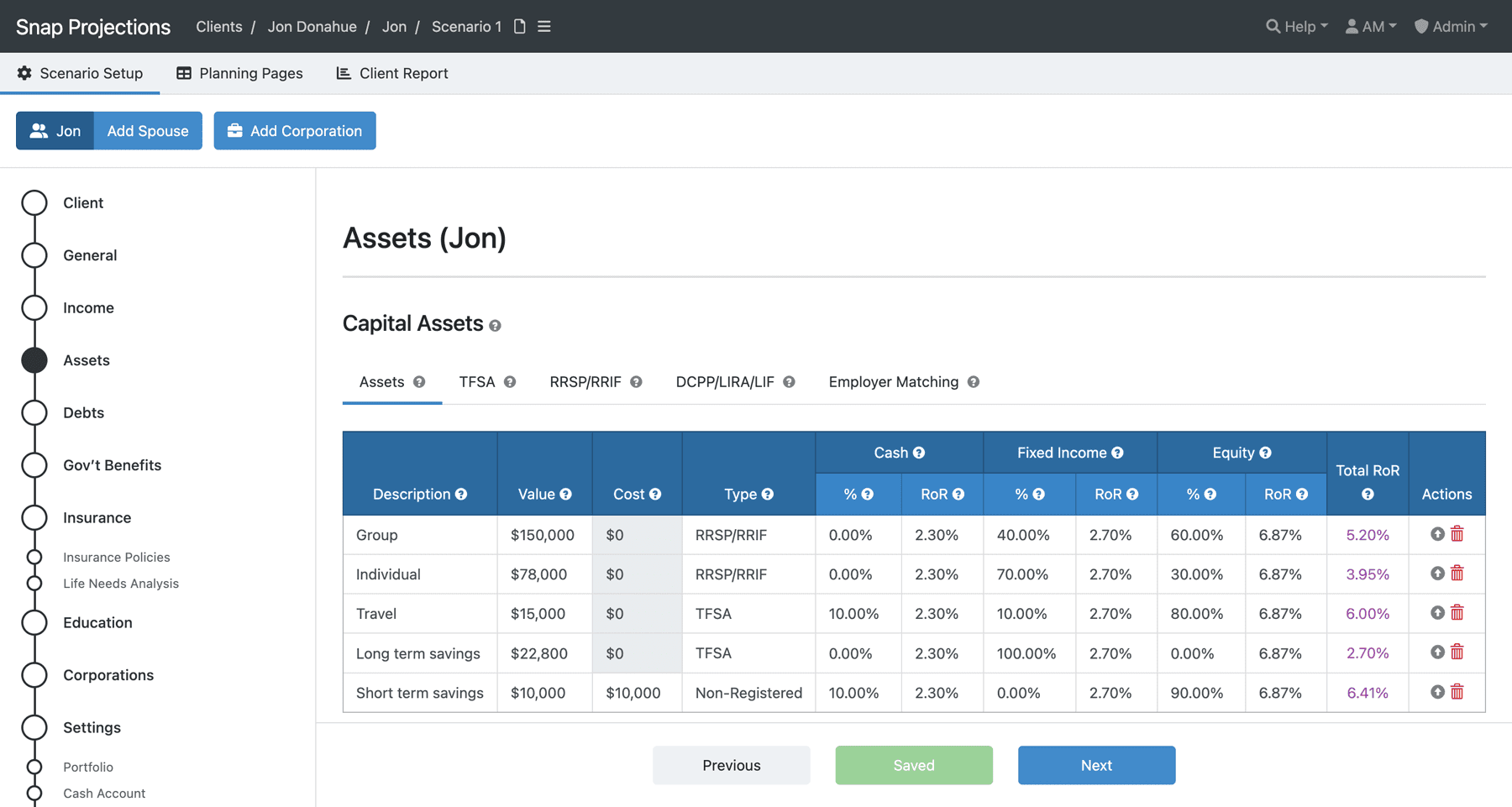

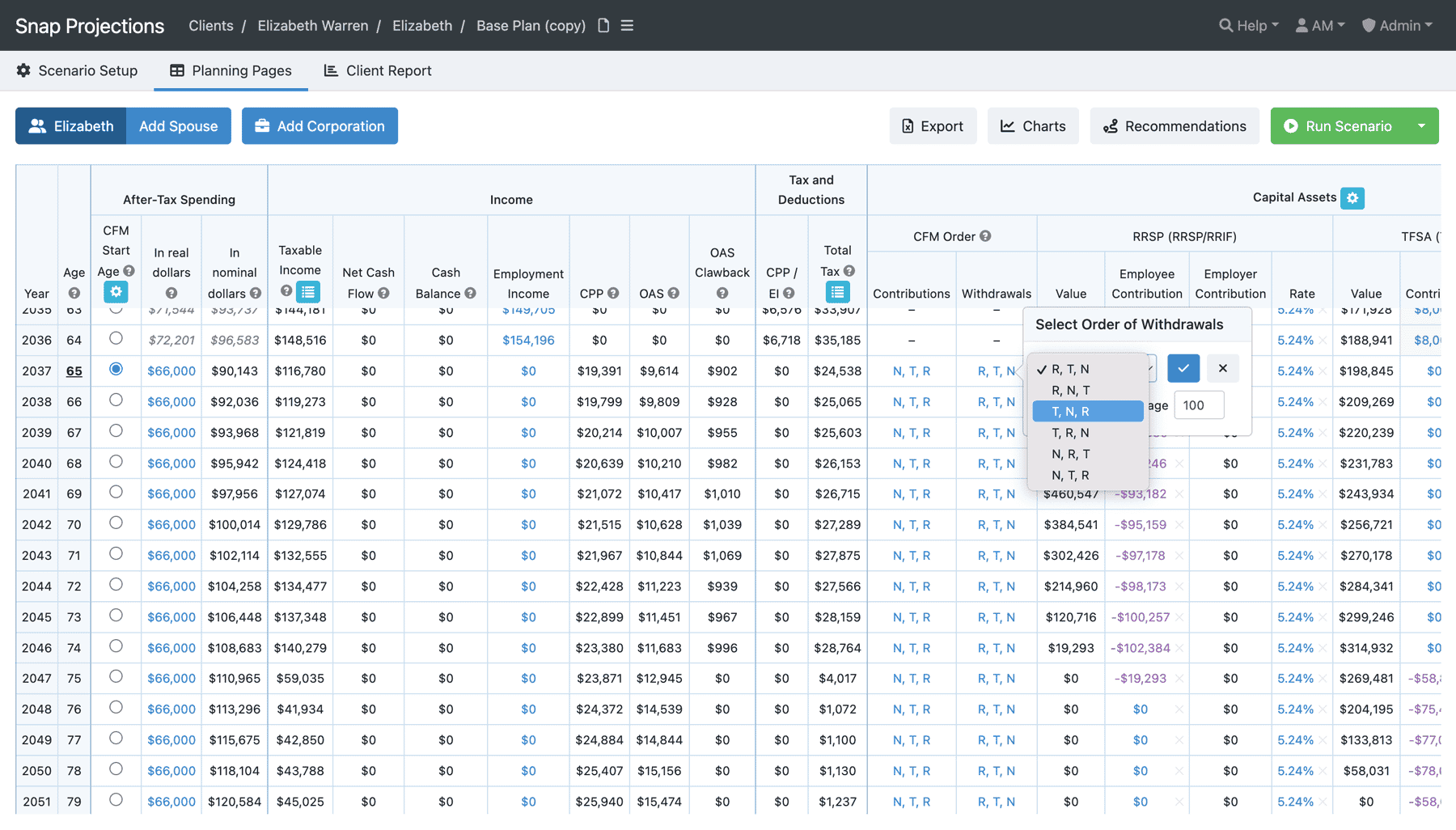

Creating multiple what-if scenarios in real time

In Snap Projections, after you’ve made a copy, there are numerous changes you can make right from the main planning page. This allows you to create multiple what-if scenarios for comparison, in real time. Any figures in blue or purple can be adjusted by simply clicking them to open the editing box.

One of the biggest planning challenges for Advisors is the inability to create multiple what-if scenarios with their clients in real time. This doesn’t mean that you are creating a new financial plan with your clients from scratch. Rather, you collected their data and created a financial plan, but while you are presenting, you may want to create another scenario quickly. For example, in Snap if the inheritance isn’t $150,000 but $350,000, you can simply copy a scenario, update that value and create a new updated scenario for the client in less than 2 minutes. You may have noticed on the chart above that both programs provide the option to create multiple “what-if” scenarios for comparison — the real differentiator here is in how quickly and effectively changes can be made and thus compared once a scenario has been copied.

In both programs, you can create multiple scenarios quite quickly. In Snap, you can then go on to make changes for comparison — many of which can be made themselves right from the main planning page, with a click or two. For example, without leaving the main screen, you can easily model increased contributions and savings, a change in salary, or modify asset classes and rates of return.

In Razor, you can also easily create multiple scenarios, there is just more work required to build in those additional changes before you can start comparing. Advisors tell us that when you copy the current scenario, you have to then click through and verify all the initial page set-ups and information before you are able to start making modifications. Then, to make your modifications and desired variances, you are again having to switch back and forth across multiple pages and ledgers to find where the information can be adjusted. After you are done, you can return to the main plan to see what those adjustments look like.

In Snap, you can copy your plan with the click of a button, without leaving the main planning page, and then begin modeling multiple what-if scenarios. The flow of this process is straightforward. You just make the changes right from the main planning page and click “run scenario” to refresh — that’s it.

Asset decumulation

In Snap Projections, you have complete control over the default logic you set for your withdrawals, plus you have the ability to make manual adjustments for all account types.

For many Advisors, asset decumulation is the primary reason they have switched, because the ability to easily model asset decumulation was essential to them. Advisors (and clients) need to see the accurate and transparent breakdown of where their retirement income will come from, and Snap makes that easy to model on the main planning page and with colorful, interactive, client-facing charts. Plus, it’s simple to build out multiple what-if scenarios when comparing various retirement goals, such as after-tax retirement income or net estate value. Each priority will dictate how to best draw-down the assets, and Advisors tell us they have been unable to find a way to easily achieve this in Razor.

Like Snap Projections, RazorPlan is optimized for tax efficiency in the decumulation phase but there are key differences in what can be modified and in how that information can be shared with clients.

In Snap Projections, you have the option to enable cash-flow-management strategies and create your own custom logic or order of withdrawals for registered accounts, non-registered accounts, and TFSAs. In addition to modifying the withdrawal or contribution default logic, you can also manually enter the withdrawal amounts that you can carry forward for as many years as needed. You can make these changes right from the main planning page, making it quick and easy to see any implications for comparison purposes. You have complete year-by-year control.

In Razor, you can make changes to the withdrawal logic, but they are limited in scope and not as easily accessed. In Razor, there are two ways to make modifications. You have the option to access settings where you can make changes to the lifestyle funding withdrawal order, selecting to prioritize either the RRSP or non-reg/TFSA. You can apply a percentage preference on that order as well. The catch here is that you can not separate out the non-registered and TFSA accounts. The second option is to adjust withdrawals manually. There are drill-down windows you can access to make year-on-year adjustments but this option is only available for registered and corporate assets — you are not able to modify the withdrawal amounts for the TFSA or non-registered accounts, those will remain automatically calculated by the software. Advisors tell us that because of this, if their client has a goal outside of tax efficiency, it’s typically a laborious process to try and model that.

And remember that with Razor, you’ve had to lump your TFSAs and RRSPs together, which means you can’t differentiate between those accounts during the decumulation phase. In Snap, you can show your clients their sources of income, on the account level, for every single year of the plan. You can easily create multiple scenarios comparing various draw-down logics and strategies, which is something Advisors tell us has been a complete game-changer for their practices after making the switch from Razor to Snap.

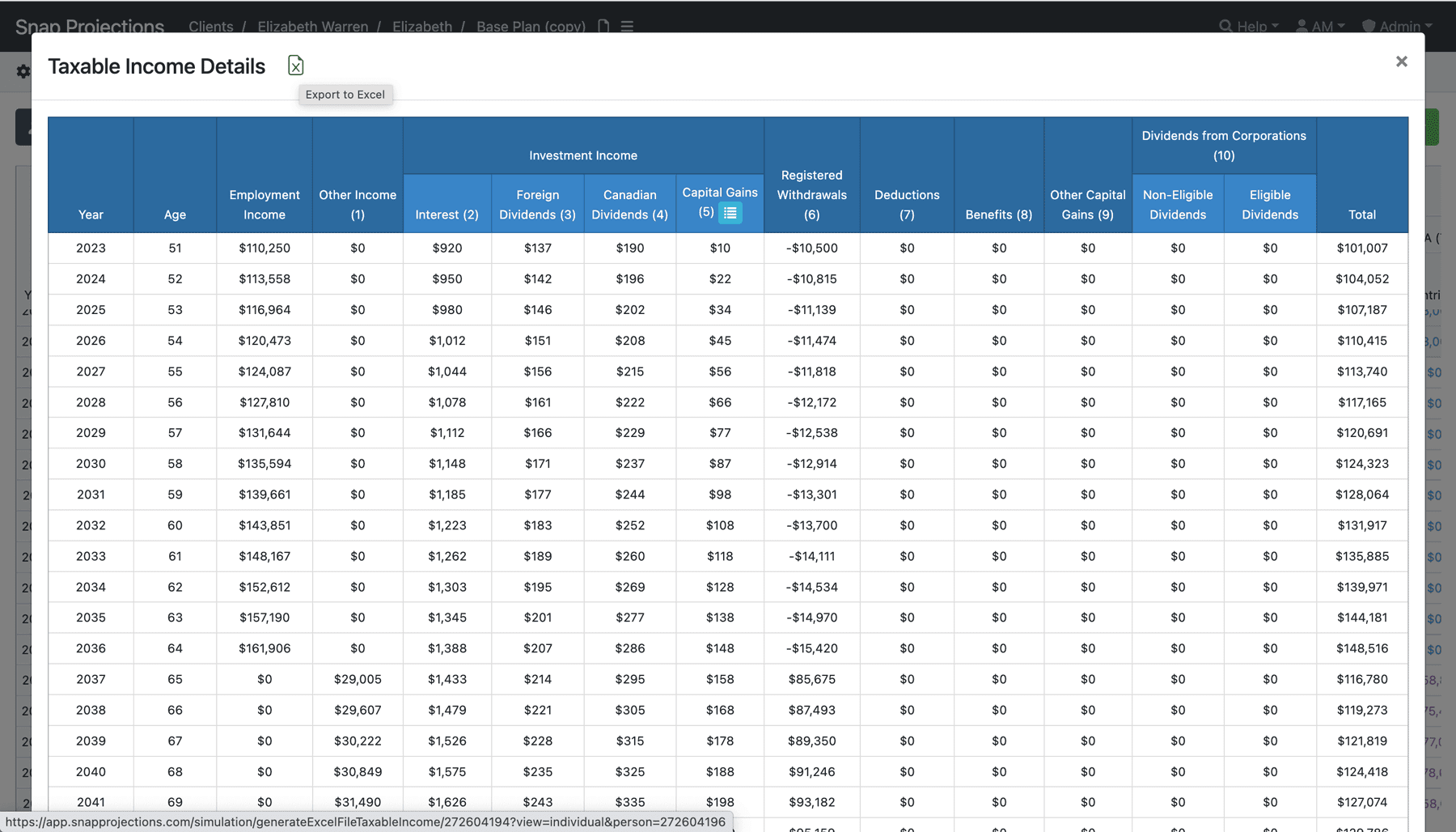

Tax planning

In Snap Projections, you can access the Taxable Income Details chart right from the main planning page. This provides complete transparency for the Advisor and sets the foundation for tax planning conversations with clients. You can even export the data to Excel.

For tax planning, there are some key ease of use differences between Snap Projections and RazorPlan. According to what Advisors have told us, both programs have all the numbers and calculations available — the core difference is that with Snap, the tax details are easier to access which typically means it’s easier to discuss with your client. In Snap, you can see right on the main planning page the total taxable income each year, plus both the marginal and effective tax rates. Within the taxable income column is a menu button you can click that will open up the tax breakdown for the entirety of the plan. With the click of a button, you can access your tax planning charts and see exactly how these figures were generated, and also export them to Excel if you’d like to pull the data out of the program and verify its accuracy. You can, right from the main planning page, make contribution adjustments and instantly see how it impacts effective tax rates or total taxes paid.

In Razor, those numbers are there, but you’d have to move around and access the ledgers to find them. Advisors tell us that Razor’s reporting options for taxes include a high-level visual that shows percentages rather than figures, and you can also pull the full ledger for all the details. But because the ledger is not optimized for printing, Advisors say it is difficult for their clients to absorb and that there doesn’t appear to be an easy way to access tax information aside from the reports, which makes having tax planning conversations more difficult. It means you can’t do things like enter various RRSP contributions to see how it impacts taxes to be paid without a substantial amount of back and forth. In Snap, you can do this right from the main planning page and get real-time updates and compare various scenarios without ever leaving the main planning page. With Snap, you’re showing your clients their whole life on one page and that includes their tax details.

Another difference between Snap and Razor with respect to taxes is the option to include individual tax credits, deductions, and benefits. Snap provides the option to include additional tax details for complete tax planning but Advisors say Razor does not allow for this level of tax planning customization.

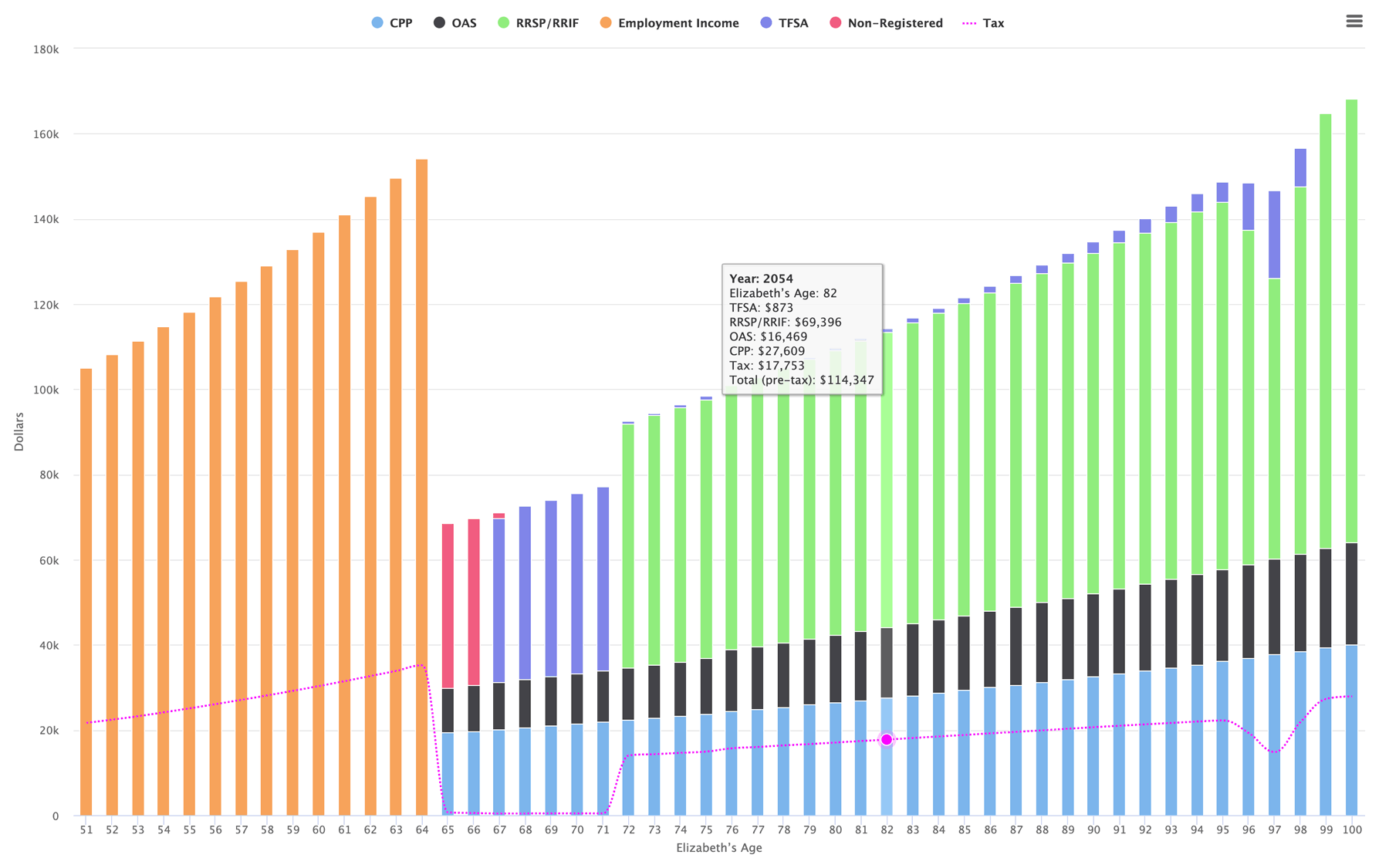

Reports, charts, & client presentations

The Sources of Income chart is one of Snap’s most used client-facing, interactive charts. This shows the client the complete breakdown of where their income will come from, for every year of the plan.

Both Snap Projections and RazorPlan provide comprehensive reports and charts for client presentations that are designed to be easily understood. The key difference here appears to be with how the reports are used.

With Razor, in order to present any information or initial plans to your clients, Advisors tell us they rely exclusively on the report. In the platform, there isn’t one place where you can easily show your clients a holistic view of what is happening, so Advisors tend to use the report for that. This means pulling a report to discuss all elements of the proposed plan, and then going back to make changes later as discussions continue.

Conversely, in Snap, Advisors use the succinct main planning page to demonstrate variables and have discussions in real time, and then use the report as more of a final piece of the pie once decisions have been made. Throughout the discussion phase, Advisors tell us that with Snap, they also leverage the Recommendations feature and interactive charts live with their clients.

Razor’s goal of keeping things simple and high-level continues throughout some parts of the reporting platform. You can pick and choose which elements are included in the report, but you aren’t able to customize anything within each section. You can’t modify the text or add your own comments — you essentially have to take what you get. But, Razor reports do have a few elements Advisors really seem to like.

There is a nice Financial Summary page that shows the client exactly where they are today. It shows a pie chart to break down assets, investment assets, and liabilities, as well as client details like age, income, and marital status. They also have a Retirement Analysis page that shows multiple options that can be compared to achieve a retirement goal.

With Snap, you have the option to pull the report at any time, but before you get to that point you will typically want to access the interactive charts that are designed for client presentations. The sources of income chart is one of Snap’s most popular and heavily used features because it’s designed to help Advisors show how the plan will truly ensure their clients’ retirement goals are reached. You’re not just getting the visual; the detailed numbers are there too, which is another way the Razor and Snap visuals differ.

When you’re ready to pull a report for your client in Snap, you have the option to pick and choose which modules are included, as well as add any required comments or contextual information in each section. There are several areas where you add your own information, such as the Goals & Objectives and Recommendations sections, and the report will be branded with your logo for a professional and polished output.

In Razor, you can add comments on one general notes section but not within the individual reporting sections. The program only lets you use their verbiage; you can of course pick and choose what modules you want to include in the report, but you can’t modify or add to the content. They do let you change the picture on the cover page though, which is something Advisors tell us they like.

Another challenge we’ve heard is that it’s not easy for the clients to really see the numbers and understand how things change with Razor reports. For example, in Snap’s sources of income chart (pictured above), you get the visual as well as the numbers. Within the reporting options, you can choose from several different reports that show the actual financial breakdown year over year of important elements such as cash-flow or net worth. In Razor, Advisors tell us that the report options for the most part include visual elements without the actual long-term breakdowns (i.e. withdrawal values, etc.) their clients want to see. You do have the option to print the actual ledgers for this information, but because they are not optimized for this purpose they typically turn out small and difficult for the client to follow.

Overall, the general consensus is that Razor and Snap reports are quite different, not only materially but also in how they are used.

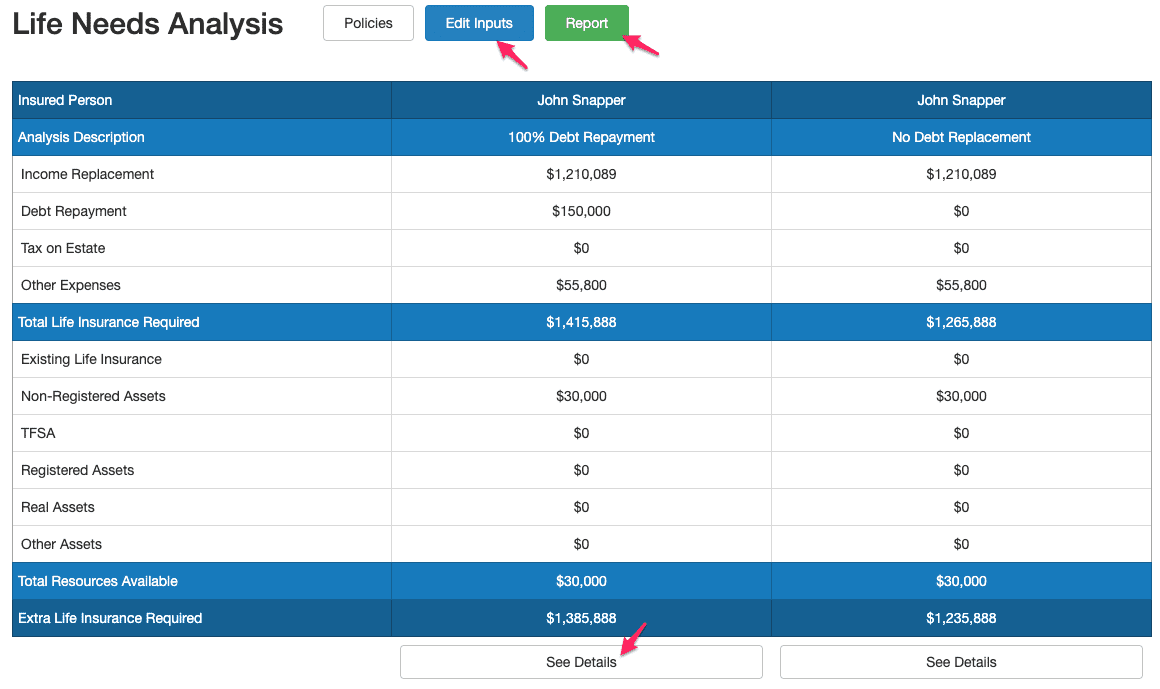

Life insurance

Snap’s Life Needs Analysis module allows you to produce a customized needs analysis for your clients in mere minutes. The details table breaks down the income replacement needs, the insurance required to pay off debt and expenses, the available resources and the extra life insurance required each year.

The Life Insurance module is another area where Snap or Razor have some significant differences.

Advisors tell us that Razor is a useful tool for positioning life insurance products because the program automatically populates a report for you that uses the client’s income to generate recommendations for life insurance, as well as disability, critical illness, and long-term care insurance.

Razor’s module is called the Risk Management Analysis; it gives you the visual of human capital (income) and liabilities, showing the gap that demonstrates the financial need should one spouse pass away or lose their income. It gives you a red line that shows the estate after taxes and you can see the visual gap that demonstrates how much life insurance is needed if your client wants to maintain their lifestyle. You can see how it changes as they age, so you can see that right now, for example, the need may be a million dollars, but in ten years that’s going to drop down significantly, so it automatically builds the case for an insurance policy.

In Snap, you can easily model in the projections life insurance policies clients already have and you can use the Life Needs Analysis tool to determine what level of life insurance your clients may need. With Snap, you have the opportunity to build a customized life insurance needs analysis that takes into account additional parameters that meet your clients’ specific set of requirements, versus providing them with a more general recommendation.

The key difference here would be that in Razor, the system populates a standardized report that Advisors say is very helpful. It’s quick and easy to have those discussions because no additional work is required to produce the standardized report. Plus, it includes disability and critical illness.

Snap goes deeper into the analysis of their needs, taking into account additional parameters than current income levels. Snap will allow you to factor in (for both spouses) income replacement needs, debt repayment, children’s education, taxes on estate, final expenses, plus any other expenses, while taking into account existing financial assets. This allows you to help your clients protect their loved ones and go deeper into those meaningful conversations, ensuring what matters most to them has been accounted for. Plus, it only takes a few minutes to generate the customized report.

Disclaimer: to the best of our knowledge, this information was accurate on the date it was last updated, Oct. 4, 2022. We can not guarantee the accuracy of this information as it is based on the real-life experiences of Snap Projections and RazorPlan users.