They asked, and we built it (again!)

We’ve just released a major product update; it’s something our users have been asking for — and it may be a functionality that your practice requires as well. It’s all about being able to dig deeper into goals-based planning with your clients using Snap’s new and dedicated Expenses functionality.

The fundamental reason for creating a financial plan is to show a user that their future spending needs and goals can be achieved. While we’ve always had a way to model expenses in Snap, we didn’t have a dedicated Expenses module that allowed for the level of detail, customization, and flexibility our Advisors wanted — because as you already know, being able to show a client how their comprehensive needs and aspirations can be met is essential to the financial planning process.

Snap Projections was born because there simply weren’t many practical decumulation and asset drawdown tools out there — our CEO and Founder wanted to equip Financial Advisors, Planners, and Investment Managers with better tools to help their clients. The software has evolved significantly over these last 8 years as we have continued to build new features and make the optimizations our users are asking for.

Download your free digital marketing guide for Canadian Financial Advisors, Planners, and Investment Managers here.

Cash-flow planning is a core element of financial planning and retirement planning, and we are thrilled to layer on an in-depth way to now easily include comprehensive and detailed goals-based planning into your projections.

Take a peek below. This short video was filmed by Snap’s Product Manager, Jim Kort, to introduce this exciting new feature to our current users:

Throughout the research phase of this Expenses Module project, Snap users told us they want:

- Both cash-flow and goals-based expense planning capabilities

- The ability to quickly show a client what expense goals need to be covered in certain years

- The ability to categorize expenses as either non-discretionary, discretionary, or as major expense goals

- Full control over what expenses are shown/highlighted within the report and charts

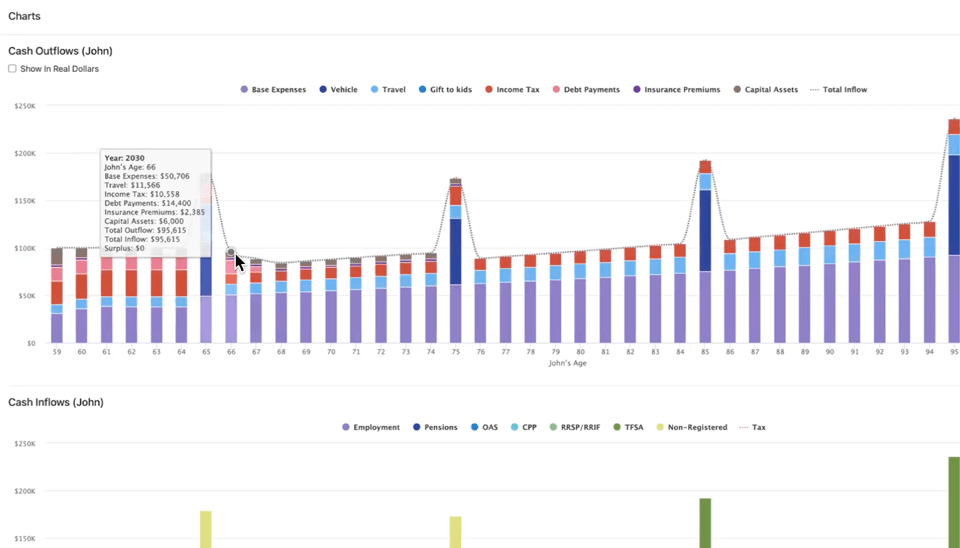

- Clear, easy-to-understand visuals that show clients how their cash inflow sources will meet expenses and other specific goals

- An easy way to show the client, without a doubt, that all their goals and expenses are covered

Want to give it a whirl? Financial Advisors, Planners, and Investment Managers can start a 14-day Free Trial of Snap Projections right here.

As a Financial Advisor, Planner, or Investment Manager, what will you be able to accomplish with these new functionalities?

As always, all new product updates and improvements prioritize you, the Advisor, maintaining transparency, flexibility, and control. You will now be able to:

- Create and label major expense goals and categories so they are meaningful and personalized for your clients. This means you can model any big-ticket expenses your clients want, such as toys, vacations, gifts to children, the potential for long-term care costs, or renovations, just to name a few.

- Highlight expenses in a new Outflows Chart for more transparency and increased client confidence

- Enter expenses either jointly (default) or individually for couples

- Easily edit/modify any year of an expense directly from the Main Planning Page, ensuring that making updates and changes remains simple, fast, and in real-time.

- Visually demonstrate whether there is any shortfall or surplus in the plan and how the clients’ cash inflow can cover their outflows over time

- Save valuable time when entering recurring expenses by using the frequency and duration feature.

The Cash Outflows chart has a Total Inflow dotted line to help you spot shortfalls. Where the Total Inflow dotted line falls below the top of the Cash Outflow bars, there is a shortfall.

Want to try it out? Financial Advisors, Planners, and Investment Managers can start a 14-day Free Trial of Snap Projections here.