1,000 people. Think about that. It’s a big number. It’s 1,000 unique points of view!

These different views have given me a fascinating perspective on how each person runs their practice. I learned about their favourite tools, what works well for them and about their day-to-day challenges. I have to admit, it’s been an illuminating process.

Running Retirement Projections with Your Clients

I would like to share what I learned about running projections with clients in interactively (You could also do the same thing online, via a screen sharing software).

Running financial projections with your clients interactively is at times a contested topic. Some advisors swear they will never do it, but the ones who have tried insist they can’t imagine their practice without it. Here are their best tips and insights, so that you can introduce, improve or perfect, this practice with your own clients.

Let me first clarify that running projections with your clients doesn’t mean literally developing projections from scratch while your clients sit and watch. It means that you’ve already developed a set of draft projections with a few different scenarios, and then you can show different options to your clients when you meet with them. For example, you can change current or maximum level of their spending, illustrate downsizing, or show the impact of delaying CPP & OAS, etc.

But let’s take it a step further than just showing the above alternatives. You can also make small modifications, for example by changing the spending level by $2,000 a year or reducing the rates of return by 1%. Showing differences like these to clients is key because you get to educate them on the sensitivity of different parameters. They often have an “Aha!” moment when they finally understand how their projections work. Then, you don’t need to convince them to review and update their projections next year, they’ll ask you for it!

This also helps to catch errors and inconsistencies. Some clients just slap their numbers together. This happens not because they don’t care. They just don’t understand how important is to use accurate spending numbers. When they see the impact of small changes on their projections, they instantly understand the value of using accurate numbers and do their homework properly.

On the flip side, you wouldn’t believe how many times clients overstate, double up or leave things off intentionally. A good practice is to go over their income, assets, debt, etc. with them to make sure we have the right numbers. You can make them more comfortable with “re-stating” their numbers by saying “when we look at a lot of numbers all at once, sometimes we miss things”. This way the client is validating our inputs to make sure all numbers are correct.

The mere act of sitting next to your client and showing what-if scenarios right in front of their eyes creates a powerful bonding moment. Sitting shoulder-to-shoulder like this establishes you as working together, which increases trust. Clients also tend to better appreciate the service that you provide if they truly understand what you do for them. Finally, the effect of educating someone is a lot more powerful and long-lasting than mere persuasion. Obviously, all of this leads to better client retention.

This is, however, only part of the story. Satisfied clients are then more likely to refer their colleagues, friends and family to you. Have you ever wondered why this happens? It’s quite straightforward. When your client’s financial future is uncertain, they are faced with an unknown, painful situation. When you help them solve it, and they gain clarity around their retirement, they’re compelled to share their story and help others overcome the same problem. This is how referrals work on the most basic level of the limbic system in our brains.

Should I Run Projections with My Clients?

There’s no clear answer, but why not give it a try? You may be pleasantly surprised by the results.

Now, how can you ensure that this endeavour is successful?

First, you need to make sure the tool you use to run and update projections can run the scenarios quickly. If you want to know more about what elements to pay attention to when it comes to evaluation of software tools, you may want to read What makes financial planning software fast?

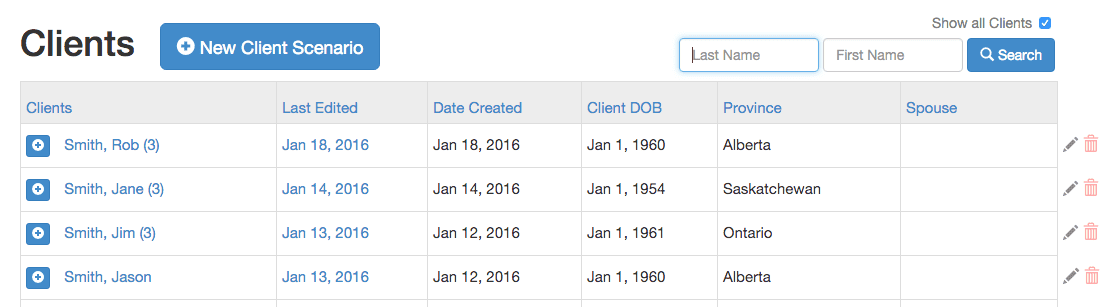

From a privacy perspective, you also want to be able to hide other clients’ information before you open up the software in front of your client or prospect. In Snap Projections, there is a convenient “Show all Clients” checkbox on the Clients page. By unchecking it, you hide all your client data, leaving only the “New Client Scenario” button and the search fields that you can use to locate your client’s file.

This his how this page looks like with the checkbox unchecked:

If you want to see all your clients again, just click the “Show all Clients” checkbox, and you’ll see your full list of clients:

Finally, if you’re showing the projections to your clients online (remotely), you’ll want to use a good screen sharing software. We wrote about some tools advisors use in 9 Software Programs to Help You Grow Your Financial Planning Practice. Check it out if you’d like to learn from other advisors like you.

If you haven’t seen Snap Projections in action yet, go ahead and watch a 5-minute Snap Projections Video. If you’ve already seen the video and you want to request access to Snap, you can book a demo here.