Integrating a holding company or an operating company into the personal retirement projections of your business owner clients is useful as often their businesses accumulated sizeable assets and these assets will play an important role in funding their retirement.

Taking the funds out of the corporation in an efficient manner can add significant value for your clients and the Refundable Dividend Tax on Hand (RDTOH) account is a key component in that equation.

What is Refundable Dividend Tax on Hand (RDTOH)?

RDTOH is a federal mechanism available to Canadian-controlled private corporations (CCPCs) that allows, under certain circumstances, for a corporation to be refunded a portion of income tax paid. The refundable portion is calculated based on the aggregate investment income generated by a corporation (Part I Tax) and on eligible dividends received by a corporation (Part IV Tax) and tracked in the RDTOH account.

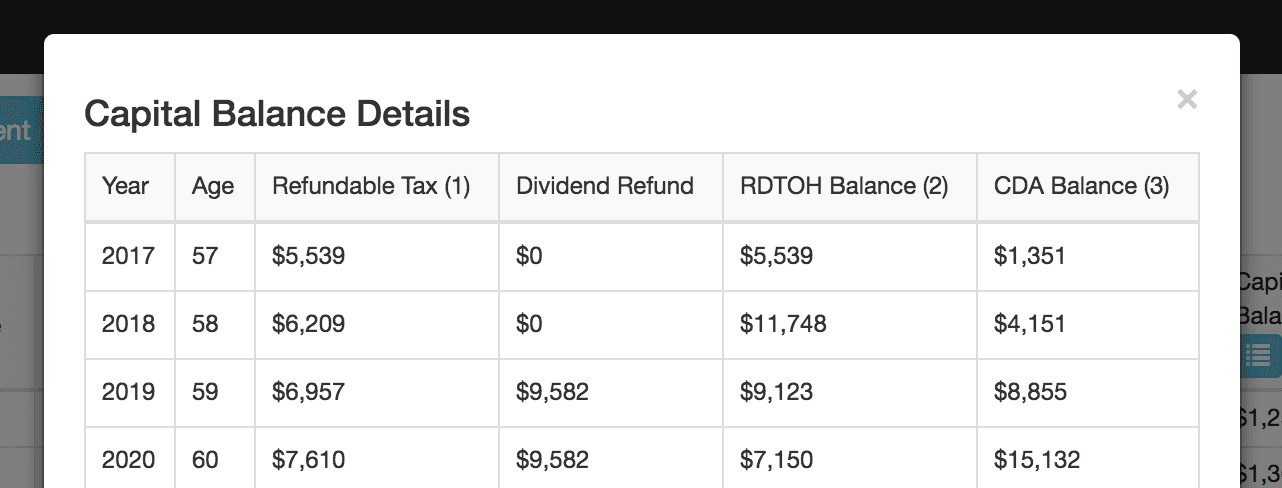

The RDTOH account balance is tracked annually (typically with the corporate tax return), and when dividends are paid out to the shareholder(s) of the corporation and if the RDTOH balance is positive, the corporation receives a dividend refund.

To make it easy to take advantage of RDTOH, the balance is tracked automatically in Snap Projections. The balance is calculated based on your selected corporate portfolio settings and the corporate asset mix, and updated based on dividends declared from the corporation.

Why RDTOH is useful?

RDTOH mechanism gives you more accuracy in terms of planning for your clients when investing in and withdrawing funds from their corporation and gives you some control over the corporate taxation as well.

This is useful because you can now be much more precise in modelling investing in a corporation. For example, you can evaluate different strategies to take the funds out of the corporation via salary, non-eligible dividends or eligible dividends and determining their impact on personal and corporate taxation. You can also test an approach of completely taking the funds out of the corporation and investing them personally.

Is RDTOH available in Snap Projections?

Yes! We are excited to announce adding RDTOH to the Business / Corporate Component in Snap Projections. Here is some more information on how it works.

RDTOH affects only investment income generated by the corporation and it does not impact the remaining corporate component’s functionality; including the active business income section.

This means you can generate both active business income and passive business income (i.e. investment income) in one corporation and both income streams will be taxed separately. That way, in Snap Projections, a corporation can act as a holding and an operating company at the same time, and you do not have to resort to setting up multiple corporations to model active and passive business income separately, which can be a closer representation of the reality for your clients.

You can continue to use the corporate component as part of an income splitting strategy for your clients – if both spouses are shareholders of the corporation you will be able to declare a dividend to one or both spouses.

You can add multiple corporations to the client’s projections and easily report on all of them within one client- friendly report.

In the end, you are able to provide your clients with an additional level of comfort that all of their assets are properly accounted for.

If you have been trying to model RDTOH in excel, you’ll love this new functionality in Snap Projections. That’s because the corporate component is as easy to use as the rest of the Snap Projections platform.

If you haven’t tried the corporate component in Snap yet or if you are curious to learn how it works, you can click here to watch a short video of the Corporate Component.

Otherwise, you can click here to book a short demo with us. You’ll learn how you can use it to plan more effectively for your clients with corporations.