If you expect that one spouse will outlive the other in your clients’ retirement projections, it’s useful to project the surviving spouse’s financial situation after the death of their spouse. We call this a Surviving Spouse Scenario in Snap Projections financial & retirement planning software.

Here’s a quick summary of what happens to your clients’ assets upon the first spouse’s death and how to avoid common pitfalls around asset rollovers.

What happens to their RRSPs?

Key terms: Annuitant and Beneficiary.

When an RRSP annuitant dies, you can roll the RRSP over to a beneficiary on a tax-deferred basis. The beneficiary must be a spouse, a common-law partner (CLP), or a financially dependent child or grandchild with a mental or physical disability.

When an RRSP annuitant dies, they are deemed to have received their RRSP assets just before death; this generally means the RRSP value at the time of death is included in the taxable income of the deceased for the year of death. However, the CRA allows a “qualified beneficiary” to receive the proceeds and report the income inclusion on their tax return instead.

When the beneficiary contributes the amount to their RRSP, they can claim a deduction to offset that taxable income inclusion. Keep in mind, though, that the beneficiary’s RRSP contribution room doesn’t change.

To avoid possible pitfalls, have your clients review their beneficiary designations to keep them updated and make sure their will matches everything else to avoid financial disasters like this one.

What happens to their RRIFs?

Key Terms: Annuitant, Successor Annuitant and Beneficiary.

When the annuitant of a RRIF dies, the rollover is performed similarly to that of an RRSP. The remaining amount received from the RRIF in the year has to be reported on the annuitant’s income tax return for the year of death unless one of the exceptions below occurs:

- The annuitant names their spouse the successor annuitant of the RRIF. In this situation, the RRIF continues, and the spouse becomes the successor annuitant under the fund. All amounts paid out of the RRIF after the annuitant’s death become payable to that successor annuitant.

- The spouse or partner is named in the RRIF contract as the sole beneficiary, and the entire eligible part of the RRIF is directly transferred to an RRSP, PRPP, SPP, or RRIF under which the spouse or CLP is the annuitant.

Possible pitfalls can include not starting the RRIF early enough. Often, it makes sense to make partial withdrawals in retirement from both registered and non-registered accounts. Snap Projections allows you to fully control the amount of withdrawals from any asset, which means you can decide and adjust how much clients should withdraw from their RRSP, RRIF, LIF, TFSA or any non-registered asset.

What happens to their TFSA?

Key Terms: Successor Holder, Survivor and Beneficiary.

If designated as a beneficiary, the surviving spouse has the option to contribute and designate all or a portion of a survivor payment as an exempt contribution to their own TFSA without affecting their own unused contribution room, subject to certain conditions and limits.

A TFSA does not terminate on death; the successor simply replaces the deceased as the plan holder, and the plan continues with all rights passing to the successor.

The successor holder is the person named to inherit the TFSA. There are two types of successor holders:

- Survivor: a spouse or CLP at time of death. The survivor can designate all or a portion of the TFSA to contribute to their own TFSA without affecting their own contribution room.

- Beneficiary: a child or qualified donee. The beneficiary can contribute all or a portion of the TFSA to their own TFSA only if they have unused room.

To avoid potential pitfalls, make sure your clients have named a successor holder − not just a beneficiary.

What happens to their non-registered assets?

An automatic rollover rule applies, and the spouse will receive the assets with no tax consequences. The disposition and transfer is deemed to have happened at ACB − not FMV, which would trigger taxes (Income Tax Act, Section 74.2).

The automatic rollover applies unless a couple “elects out” of section 74.2 and wants to have the transfer happen at FMV, which can be desirable in certain situations, for example if you want to trigger capital gain taxes in the estate of the deceased spouse.

How are asset rollovers handled in Snap?

If the projections of the spouses end in different years, the assets are automatically rolled over in the following manner:

- Registered assets are rolled over on a tax-deferred basis,

- TFSA assets are rolled over on a tax-free basis, and

- Non-registered assets are rolled over at ACB, not FMV (without triggering capital gain tax).

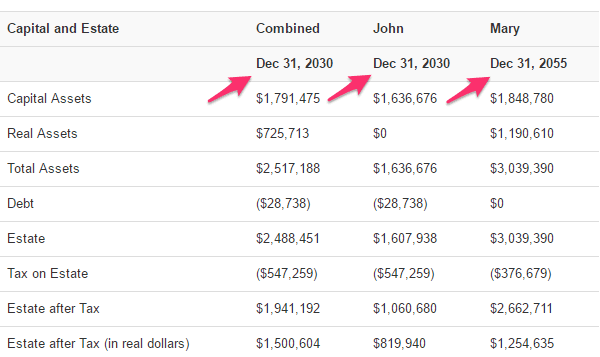

The combined page (please see the screenshot above) will show the value of their combined estate in the last year when both spouses are alive, the estate of the deceased spouse at the end of his/her projections, and the estate of the surviving spouse at the end of his/her own projections.

Note that you can further adjust the spending that the surviving spouse needs to maintain their lifestyle as their spending level can be different from the couple’s combined spending. This is an essential functionality in the financial & retirement planning software as it not only allows you to adjust the spending in different phases of their retirement (active vs. passive) but also enables you to be very precise in planning for the surviving spouse.

If you have any questions regarding rollovers, get in touch with me over email or click here to book an online demo so we can show you step by step how rollovers are handled in Snap.