Savvy financial advisors know that the key ingredient of their success is knowing what their clients and prospects truly want.

This makes perfect sense because if you know what is on your prospect’s mind, it is much easier to start a conversation with her, build trust and instantly deliver value.

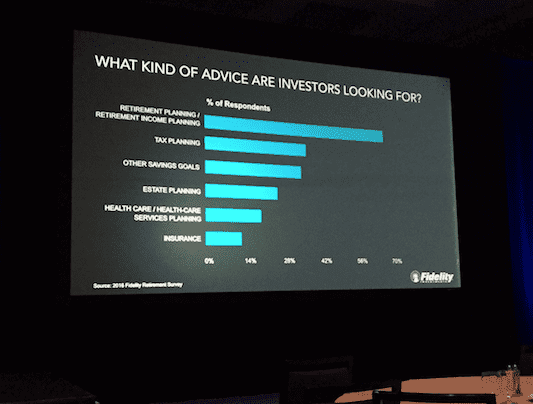

So, what kind of advice are investors looking for?

I found some useful information on this topic at one of the sessions during the CIFP’s 14th Annual National Conference.

Peter Bowen, CPA, CA, Vice-President of Tax and Retirement Research at Fidelity Investments Canada shared some of their internal research on this matter (please see the photo I snapped at the conference).

According to Fidelity’s research, there has been a lot more interest in retirement planning and retirement income planning. Retirement planning and retirement income planning is by far the most desired service among the consumers (nearly 70% of all respondents).

Tax planning, other savings goals and estate planning were the remaining services that placed 2nd, 3rd and 4th respectively with approximately 20% – 30% of respondents indicating their interest in these services. The remaining categories included health care related services and insurance.

How should we interpret this research?

I always try to be cautious when interpreting industry surveys. Mostly because there can be some confirmation bias at play. Also, we typically don’t get much insight into the methodology behind the survey, the data collection and pre-processing, types of questions asked, population size or its structure.

Nonetheless, these results intuitively make sense to me. First, because a vast majority of consumers are likely to be familiar with only one aspect of financial planning (i.e. retirement planning). They may be less familiar with estate, tax planning or financial management.

Second, I am not surprised that the majority of the respondents seek retirement planning advice. There are 13.6 million people in Canada 50 years old and older. That’s about 37% of the Canadian population. This large segment of the Canadian population is going to be predominantly focused on planning for their retirement.

How does this research help you?

As an advisor, I would consider these results as an opportunity to structure your practice around what the market currently needs, and try to fulfill that need.

Retirement planning is a great start of a meaningful conversation with a new prospect. It facilitates understanding of their needs and goals.

A set of retirement projections provides great insight into their current situation and helps to quickly pinpoint any potential issues regarding insurance, investment planning, estate or cash flow & debt issues.

Also, a retirement planning service is a great way to demonstrate the value of your services to your clients. It helps you build and maintain a relationship with clients by educating them on how to make better financial decisions.

Interested in seeing how Snap Projections helps your clients make better retirement financial decisions? Click here to book a demo and we’ll show you how.